It was truly a busy day for the market and the RBI as the morning witnessed the first RBI Monetary Policy Committee Meeting in the year 2024.

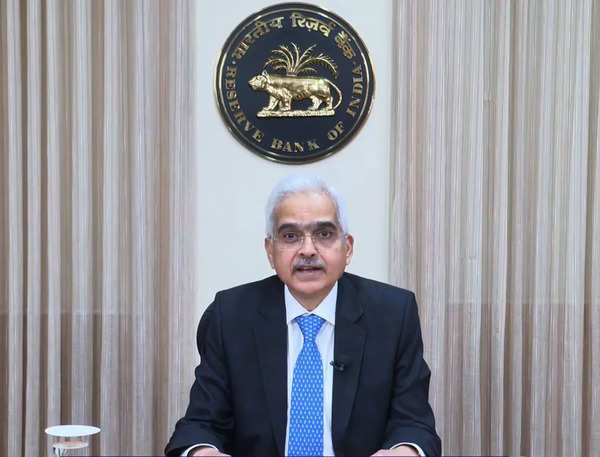

Mr Shaktikanta Das had several announcements to make concerning the Indian economy and it was one of the most anticipated events in the month.

At 10:00 Am on 08/02/2024, the RBI Governor Shaktikanta Das began his address to the press where he unveiled several data and key policy decisions concerning the repo rate, inflation outlook and also monetary indicators.

Trust us when we say that there was a lot of interesting stuff to say about all of this.

So without further adieu, let’s begin!!

RBI Monetary Policy Committee Meeting 2024: The Points to be highlighted.

RBI Governor Shaktikanta Das began the session by addressing the situation in the global economy.

He said ” The Global economy has been presenting a mixed picture. The global economy has been presenting a mixed picture and the odds of a soft landing have increased at a global scale. The emergence of new flashpoints has imparted uncertainty to global macro landscapes. “

” Through this first RBI MPC meeting of 2024. The Committee had decided to focus on customer centricity and also financial inclusion. ” said the RBI Governor.

He further said:

“The RBI MPC has decided to keep the repo rate unchanged at 6.5%. The MPC has decided by 5 votes to 1 to leave the repo rate unchanged at 6.5%. It was also decided by 5 votes to 1 by the MPC to remain focused solely upon the withdrawal of accommodation to ensure that inflation progressively aligns with the target whilst it supports growth. “

The RBI Governor Shaktikanta Das had further said that the MMPC would carefully monitor the generalization of food price pressures. He intimated to the press that inflation has softened however the situation with food price pressures could hamper the easing of core inflation.

In his view, the Monetary policy being laid down should continue to actively align the inflation to the 4 per cent target on a durable basis and the MPC is committed to doing so.

Global Markets and FDI:

In the RBI MPC Meeting 2024, the Governor had an interesting view concerning the global scenarios.

The global financial markets are volatile currently as the market participants are adjusting their expectations of the timing of rate cuts by the major central banks.

Concerning economies and their public debt scenarios, Gov Shaktikanta Das said

” The elevated levels of public debt raise issues of macroeconomic stability in adjacent countries.”

He further went in depth and said that the public debt level in developed and advanced economies is much higher than in emerging economies like India.

Furthermore, whilst talking about Forex, the RBI Governor had this to say

” The Forex Reserve in India stands at $622.5 billion as of February 2, 2024. The US Remittances have been a whopping US 125 B dollar as per the World Bank estimates. “

GDP Growth in the Country:

RBI Governor Shaktikanta Das had stated the following concerning the GDP growth.

” The FY25 GDP growth has been pegged at 7 per cent. In addition, the quarter-wise breakdown is as follows:

-April-June 2024 GDP growth forecast raised to 7.2 per cent from 6.7 per cent.

-July-September 2024 GDP growth forecast raised to 6.8 per cent from 6.5 per cent.

-October-December 2024 GDP growth forecast raised to 7.0 per cent from 6.4 per cent.

-January-March 2025 GDP growth forecast pegged at 6.9 per cent.

Inflation Data:

While talking about Inflation Mr. Shaktikanta Das had a few interesting perspectives to share as well.

The RBI Governor said that the Manufacturing sector in India remains strong. There is a possible expansion and strengthening of future activity in the PMI index and it is expected to remain strong. Furthermore, the PMI services in January are suggesting continuous strong expansion.

In addition to this, the RBI Gov said that construction activity is going to propel thanks to the government capex. The investment cycle is gaining due to government capex, the rising flow of commercial sector resources and more. Several surveys also suggest optimistic business conditions in the future.

The RBI Governor, during the RBI MPC Meeting 2024 said:

-The FY25 CPI inflation forecast has been retained at 4.5%

-FY25 CPI Inflation forecast retained at 4.5 per cent.

He further went on to subdivide this data as follows:

Quarter-wise breakdown of inflation forecast

– January-March 2024 CPI inflation forecast lowered to 5.0 per cent from 5.2 per cent.

-April-June 2024 CPI inflation forecast lowered to 5.0 per cent from 5.2 per cent.

-July-September 2024 CPI inflation forecast retained at 4.0 percent.

-October-December 2024 CPI inflation forecast lowered to 4.6 per cent from 4.7 per cent.

-January-March 2025 CPI inflation forecast pegged at 4.7 per cent.

He further went on to iterate that the CPI inflation target is yet to be reached. Amid the uncertainties, monetary policy going forward has to remain vigilant and the last mile of disinflation will be a tricky endeavour.

The CPI inflation target of 4% is yet to be reached. Stable inflation will help in the long-term growth of the economy.

RBI’s Liquidity changes:

During the RBI MPC Meeting , the RBI Gov Shaktikanta Das said

” Systemic liquidity has turned into a deficit in September 2024 after a gap of 4.5 years, however after adjusting for government cash balance, potential liquidity in the banking system is still in surplus.”

CAD in FY24 and FY25 is expected to be eminently manageable, says Guv Das

Current account deficits in FY24 and FY25 are expected to be eminently manageable, RBI Governor Shaktikanta Das said.

Currency Dynamic – India Rupee:

While talking about the situation of the Indian Rupee in comparison with other currencies, the RBI Gov had this to say

“The Indian Rupee had remained stable and it had exhibited the lowest volatility in the previous fiscal year. The recent stability of the Indian rupee despite a stronger US dollar and also elevated US treasury yield displays the strength and stability of the Indian Economy”

Additional Measures Concerning Banking:

Electronic Trading Platforms:

The RBI Governor has said that the RBI will review the regulatory framework for electronic trading platforms.

“In view of the development in the market and technology, we will review the regulatory framework for electronic trading platforms.”

He further went on to say

” Review of the regulatory framework for the electronic trading platform was issued in 2018 and this is a continuation to that”

Gold Hedging:

As per the RBI announcements the Resident entities are allowed to hedge the price of gold in the OTC segment in IFSC said the RBI Gov.

From the RBI’s perspective, this will provide more flexibility in hedging gold prices.

Loans:

A Key Fact statement is now required for all retail and MSME loans.

At present the citizens are levied processing fees and other charges apart from the interest at which the loan is given. The RBI aims to enhance the transparency in these charges instructing financial institutions to provide a Key Fact statement. Banks will be provided ample time to comply with this action.

Aadhaar Enabled Payment System (AepS):

The RBI intends to enhance the robustness of Aadhar-enabled systems to enable customers through service providers.

The RBI Gov Said,

“We propose to streamline the process of on-boarding of Aadhaar Enabled Payment System (AePS) service providers and introduce additional fraud risk management measures.”

Alternatives for SMS-based OTP:

During the RBI MPC meeting, the RBI gov said that it had proactively facilitated the SMS-based OTP technology and it has become a popular facet of banking.

“But to enhance the security of digital payments, it is proposed to put in place a principle-based framework for authentication of such transactions”, Governor Shaktikanta Das said.

CBDC Pilot Project:

Final measures included the addition of offline functionality to the retail CBDC pilot project, says Guv Das

“We propose to add programmability for specific targeted purposes and offline functionality to the retail CBDC pilot project,” Governor Shaktikanta Das.

A Perspective From Commodity Samachar:

The RBI Governor concluded the meeting with the following optimistic perspective:

“The Indian economy is making a strong and transformative growth. The International and domestic markets are showing greater confidence in the economy.

The monetary policy is in the right direction, but we must remain vigilant.

Our endeavor is seen to take a holistic approach and to bring down inflation to our target of 4%.

Coming to the matter, Ankit Kapoor, Our head of Research at Commodity Samachar had this to say about the meeting:

” The RBI is quite positive on the trajectory of our economy and as India’s we have to take pride in the fact that we’re doing well.

moving on to the economic aspect, we are expecting a stable government in the next election as well, so it’s also a positive sign for the Indian markets.

Hence, it’s suggested to keep holding your investment for the long run”

That’s all for the RBI MPC meeting roundup. We’ll be back with more updates like this soon. Until then, Happy Trading!!

Commodity Samachar

Learn and Trade with Ease

Also Read : Gold Outlook: Is there a struggle incoming amid neutral momentum in dollar? , Economic Data: Will China Inflation And RBI Policy Take Lead?

Recommended Read : Forex News Letter: Fate of Gold Hanging in the Balance?

Chat with our Analyst