As of January 21, 2025, crude oil price are experiencing significant fluctuations, driven by speculation surrounding the Trump administration’s energy policies and potential changes to U.S. sanctions on key oil-producing nations like Iran and Venezuela. This evolving landscape is reshaping investor expectations and global energy trends.

U.S. Sanctions and Potential Supply Surge

There’s been a lot of talk lately about the U.S. possibly easing sanctions on Iran and Venezuela, which could lead to a major increase in oil production from both countries. If these sanctions are lifted, it could mean a large amount of oil flooding the global market. This expected boost in supply is raising concerns that there could be too much oil available, which would likely push prices down.

Domestic Production Boost Under Trump Administration

Along with the potential easing of sanctions, President Trump’s administration has also signalled plans to ramp up domestic fossil fuel production, including expanding drilling operations across the U.S. This could add even more oil to the market. As a result, investors are adjusting their expectations, lowering their forecasts for price increases, which has contributed to the recent drop in crude oil prices.

Currently, U.S. crude futures are down, reflecting this shift in dynamics. The market is in a cautious mood as traders keep a close eye on how these policies will play out and what they mean for global oil supply and demand.

Technical Outlook for Crude Oil Price

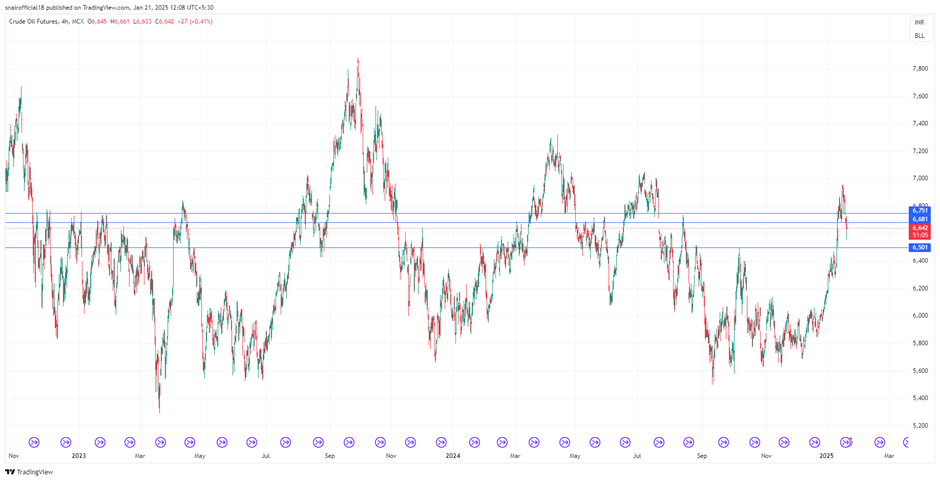

From a technical perspective, analysts are keeping a close eye on key price levels for crude oil. The current support level stands at 6500, while resistance is noted between 6680 and 6750. Should prices dip below 6500, a stronger bearish trend could emerge, prompting further declines. Traders are advised to remain vigilant as prices approach resistance levels, which may signal additional downward movements.

The combination of potential sanction relief and the push for increased U.S. fossil fuel production under the Trump administration is creating a volatile environment for crude oil prices. While it looks like prices could continue to drop in the short term, the long-term outlook will largely depend on how quickly these policy changes are rolled out and how they affect global oil supply. As these changes unfold, market participants need to stay alert and be ready to navigate the uncertainties that are shaping the energy sector.

Until then, Happy Trading!

Commodity Samachar Securities

We Decode the Language of the Markets

Also Read: UK Jobs Number, German Eco Sentiment in Focus today , Crude Oil Price Steady: What Will Trump’s Policy Bring?

Recommended Read: 2024 G20 Summit: Did It Deliver on Market Expectations?

Want Help On Your Trades ?

Chat with RM