Silver Prices struggled to hold their last four days’ winning streak. Prices retreated from the weekly high and settled with minor gains yesterday.

The U.S. dollar found some support after logging overnight losses. As stronger-than-expected U.S. economic data pushed up some appetite for risk-driven assets, weighing on the dollar’s safe-haven appeal, which added some pressure on the prices.

After the data from the US showed that New Home Sales rose at an impressive pace in May and the CB Consumer Confidence Index improved noticeably in June, the US Dollar (USD) managed to stay resilient against its rivals late Thursday. Nevertheless, the risk-positive market environment didn’t allow the currency to gather bullish momentum.

Further, today’s market will focus on Federal Reserve (Fed) Chairman Jerome Powell, European Central Bank (ECB) President Christine Lagarde, Bank of England (BoE) Governor Andrew Bailey and Bank of Japan (BoJ) Kazuo Ueda speech at a panel at the ECB Forum on Central Banking in Sintra on Wednesday. Adding to this, the US economic calendar will release Goods Trade Balance for May and the Fed will release the Bank Stress Test results later in the day.

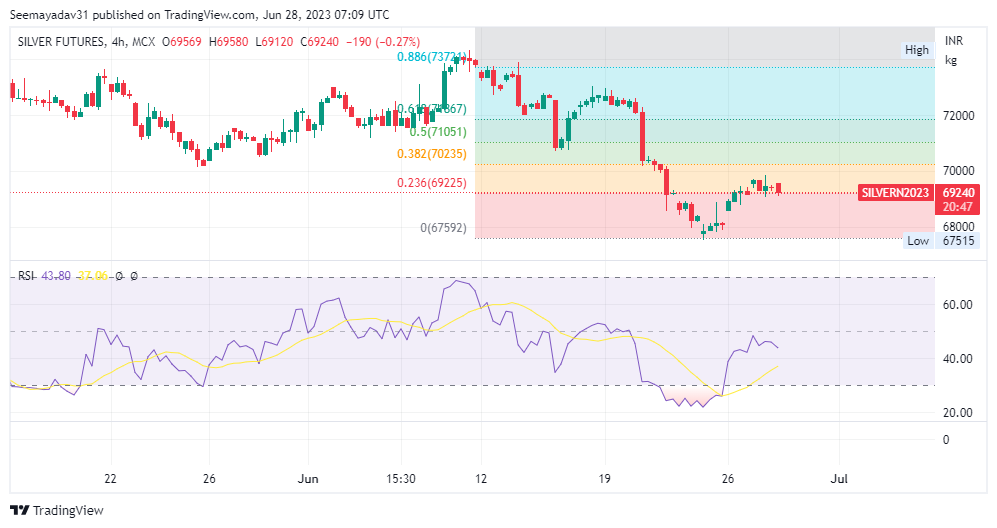

Technical Outlook

Silver futures retreated from the high of 69852 and traded at 69194 levels. Yesterday prices settled at 69341 with a gain of 0.23%.

On the above chart, prices failed to break their massive resistance of 70250.00, coinciding with 38.2% Fibonacci Retracement. Prices now trading near their immediate support of 69050 a break below will put pressure on the prices. It could test 67950 and below.

On the other hand, on the upside immediate resistance is seen at 70050-70250. A break above only will test the next resistance 71000-71550.

Hence, traders may take a short position below 69050 for a downside target 67950.00 with a stop loss above 69950.00