Here in this blog, I am going to converse about the detailed facts about two robust currencies: The Euro and the Dollar.

Let’s begin with…!!

The Dollar Index is currently up by 0.01% and trading around $79.88. For the past n number of days, the dollar is persistent in making a green candle.

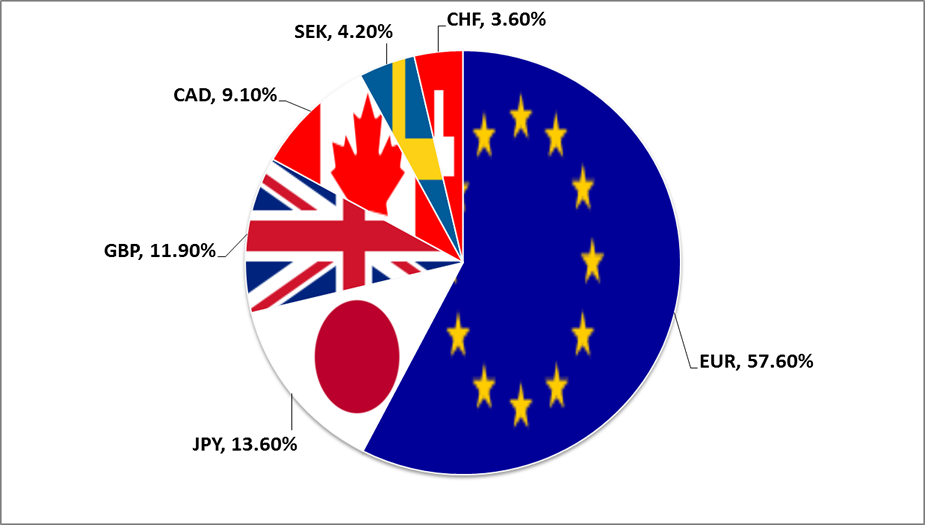

Furthermore, the dollar index comprises six currencies. They are as follows:

Euro – 57.6% weightage in the dollar index

Japanese Yen – 13.6% weightage in the dollar index

Pound Sterling – 11.9% weightage in the dollar index

Canadian Dollar – 9.1% weightage in the dollar index

Swedish Krona – 4.2% weightage in the dollar index

Swiss Franc – 3.6% weightage in the dollar index

Based on the parameter of weightage, the Euro comes with an utmost impact on the Dollar Index as it contains 57.6% say. Now with this handful of information, we can say that if the dollar index goes up then the Euro will tumble down and so as metals.

On the contrary when the dollar index goes down then the Euro will climb up.

How a hike in interest rates by European Central Bank mends the economic health of the country?

Yesterday, during the ECB Press Conference, the central bank raised the interest rate by 0.50 BPS for the first time in over a decade. To curb the soaring inflation, the policymakers took the stringent step toward tightening of monitory policy.

A hike in interest rates may attract investors to shift their interest from scrips and commodities toward Fixed Deposits. Furthermore, fixed recurring income will improve the purchasing power of an investor. As a result, a big crash in both the stock and commodity market may witness in the next couple of days.

Controlled inflation may improve the economic situation of the country thereby raising the purchasing power and deteriorating the number of unemployment claims.

Furthermore, the spiked rate of interest has provided support to the base metals. The foremost reason is when the economy of our country recovers then the demand for precious metals increases which thereby hits the prices up.

Technical Analysis of Copper

Copper is trading range bound. Traders may work on the support and resistance levels. Here in the chart, we highlighted a circle which identifies a range bound trend in copper. If the levels breaks that circle only then we will be able to provide fresh new levels. Till then, trade in a limited range.

For more informative blog, stay tuned with us!!