It’s a great time for commodity traders as gold trading has supported them in the sights of a potentially crumbling economic situation.

As per the latest reports coming in, Gold prices rose in Asian trade on Wednesday, thereby reaching a near 7 -month high as a string of dovish signals from the Federal Reserves have wreaked havoc in the central banks.

Fed Governor Christopher Waller in a recent briefing the previous day that the bank needed to be more cautious in keeping rates higher for longer and that easing inflation may spur the bank into loosening policy earlier than expected. he had estimated an at least 40% chance that the FED would cut rates as soon as March 2024 and the central bank will keep rates on hold in December.

With FED Chairman Jerome Powell also set to speak later this week, what will be the impact on commodities like gold?

Here’s Commodity Samachar’s report for 29/11/2023.

Gold Report By Commodity Samachar:

Gold (XAUUSD) is trading at their highest-level rally above $2011-$2018-$2048-$2051 and in MCX 62800 since May 2023.

- The October New Home Sales fell by 5.6% MoM to 679k, below the market expectation.

Are you looking to invest in gold or use this precious metal to make jewellery?

If you are, then you likely might be wondering what affects gold prices?

Predicting the price of gold isn’t as easy as tracking supply and demand during Gold trading. Several factors influence the price of gold, making price predictions tricky. The most common factors affecting the value of gold might just be historical events throughout history especially related to the dollar. To understand this we have to understand how the commodity fell throughout historic events in the United States.

These are primary factors affecting gold:

Supply and Demand

The basic theory of supply and demand economics affects gold prices like the costs of other goods and services. When demand increases and supply decreases, prices go up. On the other hand, prices decrease when supply soars and demand decreases.

The Value of the US Dollar

Currency fluctuations in the U.S. dollar directly affects per-ounce gold rates. The dollar’s value and gold tend to have an inverse relationship: when the dollar falls, gold rises, and vice versa. Collectors and investors tend to purchase more gold when the dollar is weaker, and because they can get more for their money, which raises demand and the price of gold in latest gold trading.

Central Banks

The central banks of countries worldwide also affect the value of gold depending on how much they purchase for their gold reserves. Since the United States stopped using the gold standard, other countries have begun transferring their government reserves from paper money into gold, increasing the demand and causing gold prices to increase.

Interest Rates

Investors are constantly weighing risk versus reward. When interest rates decrease, investors look to alternative assets like precious metals and other commodities to get higher returns. The Federal Reserve sets interest rates and provides commentary on current trends. Gold investors track these trends and buy and sell gold according in gold trading sessions. When the Federal Reserve indicates high interest rates, gold prices tend to fall, and if they imply a decrease or no change in interest rates, the gold price rises.

Economic Fluctuations

Times of economic growth tend to witness lower gold prices because inflation and other economic data influence interest rates, which affect the opportunity cost of investing in gold. In contrast, when the economy struggles with higher unemployment, low GDP, and weak job growth, the price of gold may increase.

Reasons for Past Gold Price Hikes:

- Kargil War was fought between India and Pakistan from May to July 1999 in the Kargil district of Jammu and Kashmir.

- In 2001, the Indian Parliament Attack was orchestrated by terrorists in New Delhi, India on 13 December 2001.

- Mumbai Attack On November 26, 2008, 10 Pakistani terrorists infiltrated south Mumbai via the sea and launched attacks at several locations in the city.

- US Terrorist Attack

The USA is considered a safe place for gold and as you all know, gold is considered a safe haven currency. However, during US terrorist attacks, there was a fall in gold between $1920 -$1934.

- Surgical Strike

Similarly, In India, when the infamous surgical attack took place, there was a significant fall in gold between $1340 – $1122.

- Covid-19

In global markets, gold jumped to six-month high at $2021 with the dollar index remaining steady. A weakness in US dollar makes greenback-priced bullion more attractive for overseas buyers.

Here are some of the most significant peaks in gold prices in recent years –

- May 2023 – Gold prices hit an all-time high of Rs 62,720 per 10 gm owing to an increase in US Federal interest rates.

- March 2022 – The highest price of gold in 2022 reached around Rs 55,000, caused by market uncertainty due to the Russia-Ukraine conflict and rumours of inflation.

- August 2020 – Gold reached its peak price of Rs 56,191, fuelled by global monetary policy shifts, low-interest rates, liquidity, and pandemic-induced uncertainties favouring safe-haven investments.

Why gold prices are on the rise?

- The US Federal Reserve has finished raising interest rates, and a weaker dollar.

- Central banks continue to drive demand in gold trading, having bought a record 1,136 tonnes of gold last year and 800 tonnes over the first three quarters of 2023, according to the World Gold Council, an industry group. The People’s Bank of China has led the way this year, acquiring 181 tonnes, followed by Poland, at 57 tonnes, and Turkey, with 39 tonnes.

- Gold is often viewed as a safe-haven asset during times of geopolitical turmoil or uncertainty. The recent Israel-Hamas conflict and other global geopolitical tensions have heightened uncertainty, leading investors to seek the security of gold. As long as these conflicts persist or escalate, the demand for gold in gold trading is expected to remain strong, which can drive up its price.

- Currency Exchange Rates: The price of gold is often influenced by currency exchange rates. When the Indian rupee weakens against the U.S. dollar, it makes gold more expensive for Indian buyers. A weaker rupee can occur due to various factors, including higher oil prices or changes in global economic conditions. This can contribute to higher gold prices in India.

- Cultural and Seasonal factors: Gold is deeply ingrained in Indian culture, and it plays a significant role in various festivities, especially during the wedding season and Diwali. As these auspicious occasions approach, the demand for gold tends to surge, putting upward pressure on its price.

- Investment and Speculation: The anticipation of rising gold demand during times of uncertainty can lead to speculative buying trend by traders and investors. Their actions can drive up the price of gold as they seek to benefit from potential price increases.

- Last week, the bank’s economists said they don’t expect the Federal Reserve to cut interest rates until the end of the fourth quarter of next year. The economists see only a 15% chance the economy will fall into a recession next year.

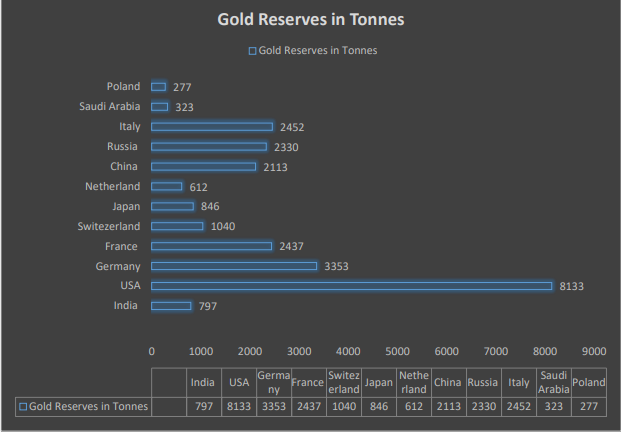

Countries With The Largest Gold Reserves:

Gold is an important component of central bank reserves because of its safety, liquidity and return characteristics.

Smart ways to invest in Gold:

- Gold ETFs

- Physical gold

- Digital gold

- Gold Mutual Fund

- Sovereign Gold Bonds

What’s Next In Gold Trading?

Currently gold is trading around $2050(xauusd) & in MCX 62800, there is a major support in comex $2030 and resistance is $2080. Now gold is in bullish trend and we may expect the gold will shine near $2070 if comex gold cross the level of $2055. In MCX , if it goes above 62800 we may expect the upper targets of 63300-63800-64200. We will not recommend selling gold at this price range. But we expect gold to give some correction in the market.

Final Note From Commodity Samachar:

As we all know gold is the safest asset for investment purpose, we may expect demand for gold to remain strong for the rest of the year. “It’s a strong season for buying gold. We’ve got the Indian wedding season, Christmas and Chinese New Year. So, it’s a good time to invest in gold and dabble in the gold trading”.

Commodity Samachar

Learn and Trade with Ease

Also Read: Crude Oil : What Lies Ahead on the OPEC Meeting Horizon?, RBI Gold Reserve On the Rise. Hinting at Recession Ahead?

Recommended Read: Crude Oil : What Lies Ahead on the OPEC Meeting Horizon?

Want advice and help on your trades?

Chat With Our Analysts