Trendy XAU/USD

As expected, we have seen range-bound trading in Gold. Gold falls vertically after the FED statement in the previous week and now it is in the consolidation phase.

Now, what to expect???

Gold has support at $1760 and resistance at $1805.

Gold formed bullish Harami pattern on the weekly chart.

Break and close below $1760 will take it to $1745 levels. More and more downside panic we will see on a weekly close below $1745. Else it could test its resistance level of $1805 again.

Break and close above $1805 will take Gold to $1860—$1890 levels.

Trade safely as per levels given above. More we will update during market hours.

Trendy XAG/USD

Comex Silver too is facing resistance at $26.40 and support at $25.50

Decisive break and close below $25.50 will take Silver to $24.20—$23.50 levels in days to come.

Or, else it could test its resistance level of $26.40 again.

More and more upside rally we will see on a close above $26.40 levels only.

Silver is trading near to 61.8% from its previous rally. We are highly bullish in Silver for medium to long term.

Chances are bright that Silver will bottom out soon.

Trendy Comex Copper

We clearly indicated to buy Copper around $4.10. Our expectation fulfilled and spurts to $4.34 and finally settled around $4.29.

Now, what next?

Below $4.26… Sell it with stop loss of $4.35 for the downside target of $4.19—$4.13—$4.01.

Traders can try to grab copper again in panic around $4.13—$4.01 with stop loss below $3.78 for an upside target of $4.33—$4.51 and then to $4.64.

Trendy Nymex Crude oil

We have seen Mind blowing rally in Crude oil. Crude oil prices rallied from $71 to $74.25 levels.

Now, what next???

Crude oil has support at $72.80 while resistance at $74.50.

Crude oil looks positive above $74.50 and could test $77—$78 and then to $80 levels. Else, it could test its support level of $72.80 again.

Break and close below $72.80 will take it to $71.20—70.30 and then to 68.50 levels.

Overall trend is positive but trade with levels only. Don’t jump for aggressive selling in it. Try to buy near the support levels.

More we will update during market hours.

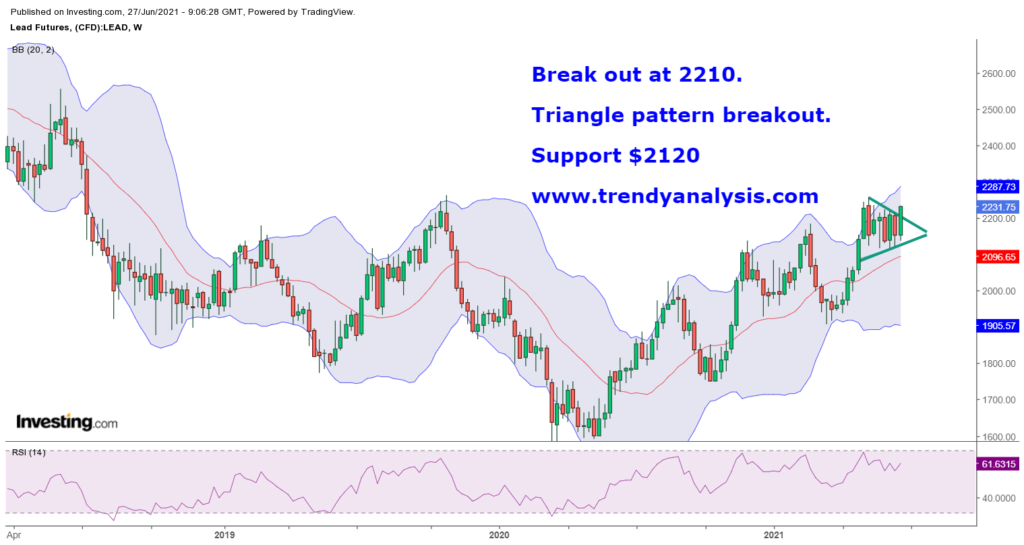

Trendy Comex Lead

In the week, we have seen a positive momentum in the stock.

A triangle formation pattern we have seen on the weekly chart. Chances are bright for an upside move in Lead.

Lead has support at 2100 and resistance at 2260.

Looks positive and could test its resistance level of 2260.

Decisive break and close above 2260 will take Lead to 2350—2420 levels.

Traders can try to buy Lead around 2200 with stop loss below 2100 for an upside target of 2350—2420.

For more updates, stay connected with us !!