1. Macro, Fundamental & Technical Overview

Silver continues to trade within a structurally bullish macro environment supported by multiple fundamental tailwinds:

- Macroeconomic Backdrop:

Inflationary pressures in the U.S. and EU remain persistent, pushing real yields lower and sustaining precious metals demand. Central banks, especially in emerging markets, have been quietly increasing strategic metal reserves—favoring silver for its dual utility as both an industrial and monetary asset.

- Industrial Demand:

Silver’s unique positioning in clean energy—particularly solar PV, electric vehicles, and semiconductors—is now translating into inelastic industrial demand. Recent quarterly updates from solar panel manufacturers show a 13% YoY rise in silver consumption, reinforcing the long-term demand narrative.

- Technical Outlook:

After reaching our earlier forecast of $39, a controlled pullback has brought prices to $37.90–$37.80. This zone is a textbook example of a retest of breakout levels before potential continuation. As long as $37 holds on a closing basis, the uptrend remains intact

2. Institutional Interpretation

Institutional players demonstrated discipline in booking partial profits as silver neared $39. However, positioning has not turned bearish:

- ETF outflows from SLV and other silver funds have been modest, suggesting rotational adjustment, not trend reversal.

- Commercial hedgers have only marginally reduced long exposure.

- Options skew continues to favor downside protection, confirming that institutional capital is hedging volatility but not exiting long bias.

In summary, institutional behavior reflects confidence with caution—typical of an early-stage macro trend supported by real demand and speculative interest.

3. Correlation with Global Events

Silver is currently trading in sync with major macro signals:

- US Tariff Wars:

Renewed threats of widespread tariffs by former President Trump and USTR allies have rekindled fears of a trade slowdown, historically bullish for safe-haven assets.

- Dollar Index & Real Yields:

DXY has softened amid growing expectations of dovish policy adjustments post-Q3, supporting dollar-denominated commodities. At the same time, real yields are falling again, which statistically aligns with strong silver performance.

- Geopolitical Crosswinds:

Escalating military tension in Eastern Europe, coupled with unstable crude oil pricing due to Middle East output threats, is pushing investors back toward physical assets like gold and silver for safety.

4. ETF Flows & Retail Sentiment

- SLV & Global ETF Positioning:

The world’s largest silver ETF, SLV, saw marginal weekly outflows of 0.3%, largely due to short-term traders exiting after target achievement. Long-term positioning remains resilient.

- Retail Sentiment:

Net-long positions among retail traders remain elevated at around 56%, but not yet in the danger zone of a contrarian reversal. Sentiment continues to favor higher levels in the medium term.

5. Seasonality Snapshot

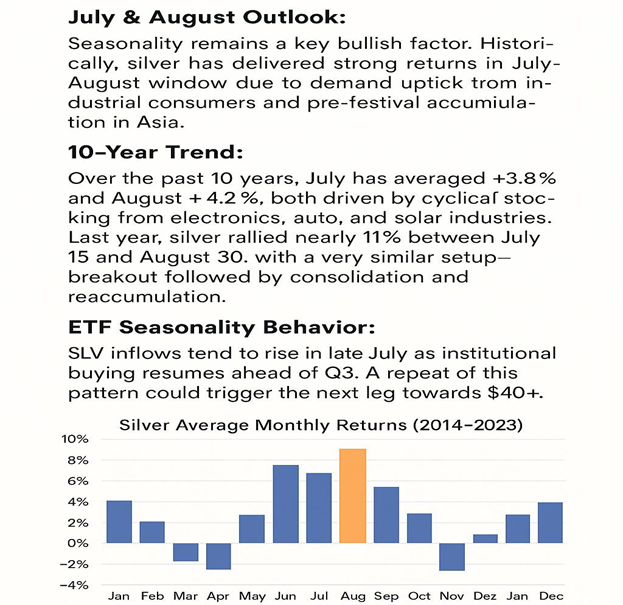

- July & August Outlook:

Seasonality remains a key bullish factor. Historically, silver has delivered strong returns in the July-August window due to demand uptick from industrial consumers and pre-festival accumulation in Asia.

- 10-Year Trend:

Over the past 10 years, July has averaged +3.8% and August +4.2%, both driven by cyclical stocking from electronics, auto, and solar industries. Last year, silver rallied nearly 11% between July 15 and August 30, with a very similar setup—breakout followed by consolidation and re-accumulation.

6. Headline-Driven Market Impact

The silver market is increasingly sensitive to a perfect storm of headlines that blend monetary uncertainty, political instability, and industrial urgency. Several key drivers stand out:

- Trump’s Return to Tariff Rhetoric:

Recent statements have rattled global markets, particularly with threats of across-the-board tariffs. Silver, being a safe-haven and industrial metal, is uniquely positioned to benefit from both economic fear and supply chain recalibration.

- Geopolitical Risks:

Silver prices react swiftly to headlines involving war, sanctions, and global tensions. With heightened tension in both the Eastern Bloc and South China Sea, silver could see panic-led spikes in the short term.

- Central Bank Signals:

Even small hints of a dovish turn by the Fed or ECB—especially in the face of slowing growth—could ignite a strong liquidity-driven rally in silver, similar to the breakout rallies of 2010 and 2020.

- Narrative-Driven Fund Flow:

The broader investment community is beginning to treat silver as a hedge against energy transition disruptions, with rising coverage in financial media. This narrative shift alone can lead to speculative momentum flows and sharp repricing.

7. Technical update

XAGUSD (Spot Silver)

Silver completed our $39 target and is now undergoing a controlled pullback. Price has entered the $37.90–$37.80 Re-accumulation zone, aligning with prior breakout levels.

- Accumulation Zone: $37.90–$37.80

- Stop-Loss (Daily Close): $37.00

- Bias: Bullish above $37.00; retracement is healthy, not corrective

MCX Silver (Current Contract)

MCX Silver is stabilizing near ₹1,11,000 after target achievement. This zone corresponds with short-term support and prior breakout confirmation.

- Reaccumulation Zone: ₹1,11,000

- Stop-Loss (Close Basis): ₹1,07,000

- Bias: Positive structure intact; ₹1,07,000 is a key risk level