Executive Summary

The US -China trade conflict has entered a new and more intense phase. Recently, the U.S. government led by President Trump has temporarily paused most global tariffs for 90 days to calm financial markets. However, the U.S. has significantly raised tariffs on Chinese goods—up to 125%—targeting items like electric vehicles, batteries, and tech products.

This decision will likely shift global trade flows and create supply chain disruptions. It could also present a major opportunity for countries like India to step in as an alternative supplier, helping grow exports and manufacturing.

This report analyzes how the ongoing trade war could impact the Indian economy, which sectors may gain or suffer, and how commodity markets might respond.

Recent Developments: U.S. Tightens Pressure on China

- On April 9, 2025, the U.S. announced a 90-day pause on global tariffs (excluding China) to ease concerns from businesses and investors.

- At the same time, tariffs on Chinese imports—especially high-tech and green energy goods—were increased to as much as 125%.

- This shows a clear push by the U.S. to reduce dependence on China while maintaining trade ties with other countries.

- In response, China has tightened controls on the yuan and may introduce economic support measures to protect its key industries.

How This Affects India

2.1 Sectors That May Benefit

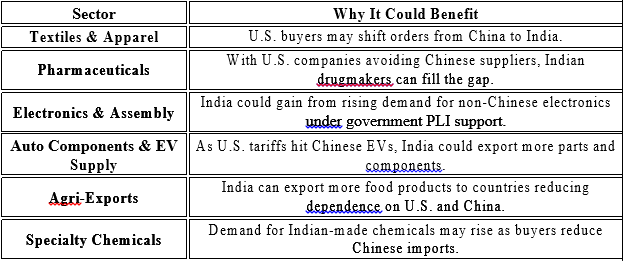

India could benefit from companies and countries looking to reduce their dependence on Chinese products. This could drive demand for Indian alternatives in multiple sectors:

2.2 Sectors That May Face Challenges

Some Indian sectors may experience indirect pressure due to global trade uncertainty or price shifts.

3. Export Potential for India

Why India Is in a Good Position

- Global companies are now following a “China-plus-one” strategy—choosing a second supplier outside China.

- India offers a large workforce, policy support like PLI schemes, and growing infrastructure.

- These factors make India a strong candidate to attract more exports and manufacturing shifts.

Key Export Destinations

- United States – Demand for textiles, pharma, electronics, and chemicals may rise.

- Europe and UK – Looking to reduce reliance on China, could prefer Indian products.

- Middle East and Africa – These regions may provide new markets for Indian goods.

Impact on Commodities Market

4.1 Energy (Oil and Natural Gas)

- If China’s demand for oil slows, global prices may fall.

- This benefits India by reducing import costs and improving margins for refineries like Reliance, HPCL, BPCL.

4.2 Industrial Metals

- Oversupply from China could cause global prices of metals like steel and copper to drop.

- Indian manufacturing might benefit from cheaper inputs, but metal producers may face price pressure.

4.3 Agricultural Commodities

With the U.S. and China in a trade standoff, India can increase exports of food products like wheat, rice, sugar, and seafood to countries facing supply gaps.

4.4 Precious Metals

- Rising uncertainty may lead to higher demand for gold as a safe investment.

- This could benefit gold investors, but make gold jewelry more expensive for consumers.

Investment Strategy and Market Outlook

Growth Themes to Watch

Sectors That Need Caution

The U.S. has paused tariffs globally but increased pressure on China, which creates both challenges and strategic opportunities. India is in a strong position to expand its export footprint and benefit from shifting global supply chains.

However, to make the most of this opportunity, India must act quickly—improving trade infrastructure, easing regulations, and supporting exporters. At the same time, commoditymarkets are likely to remain volatile, and investors should monitor key sectors that could benefit or face short-term pressure.

This moment could be a turning point for India’s rise as a trusted global supplier and manufacturing hub.

Until then, Happy Trading!

Commodity Samachar Securities

We Decode the Language of the Markets

Also Read: RBI Big Moves: What 3 Years of Data Reveal , Why Is Germany Holding So Much Gold Right Now?

Recommended Read: India’s Semiconductor Surge: Powering the Future of Electronics!

Want Help On Your Trades ?

Chat with RM