The events of the past day indicate that, partly due to longer-term trends and partly because of U.S. President Donald Trump , influence in the oil market has moved from Riyadh to Washington. Trump stated on Tuesday that charges on Chinese goods will double to 20% and that 25% of imports from Canada and Mexico would be impacted by 10% tariffs on Canadian energy. As the outlook for trade and economic activity declined, the three largest trading partners of the United States responded, and international markets withdrew. Oil prices fell along with U.S. stocks and bond yields.

Market anxiety was increased by news that the United States might suspend military assistance to Ukraine in the wake of last week’s heated argument with President Volodymyr Zelenskiy. Crude prices were under more downward pressure as a result of speculation about a potential end to the conflict in Ukraine and the relaxation of U.S. sanctions against Russia.

OPEC+ Announces First Output Increase Since 2022, But Washington’s Headlines Steal the Spotlight

What would have been a huge statement for the oil markets—that the Organization of the Petroleum Exporting Countries and associated producing nations, or OPEC+, would proceed with the first output increase since 2022—was overshadowed by the headlines from Washington.

OPEC+ to Ease Production Cuts by 2.2 Million Barrels Per Day, But Market Realities Suggest Oversupply

OPEC+ will release 2.2 million barrels per day of production curbs over the next 18 months, beginning in April.

“Healthy market fundamentals and the positive market outlook” were cited by the group as the reasons for their choice.

However, the physical market does not reflect that. Prior to any OPEC+ production increases, the International Energy Agency predicted last month that global supplies will surpass demand by almost 103 million barrels per day this year.

Therefore, the OPEC+ move seems to have political motivations, especially because Trump has urged Saudi Arabia to reduce oil prices. Another interpretation of the action is that Saudi Arabia is giving Trump freedom to put fresh sanctions on Iran, the country’s longtime opponent, which exported around 2 million barrels per day last year.

OPEC+ Struggles to Maintain Control as U.S. Production Surges and Internal Discipline Erodes

The market’s response and Trump and OPEC’s actions demonstrate how drastically the balance of power has changed in the oil sector. However, for more than ten years, OPEC’s power has been waning.

Indeed, the aggregate production of OPEC+ members is 35 million barrels per day, which gives them significant market power.

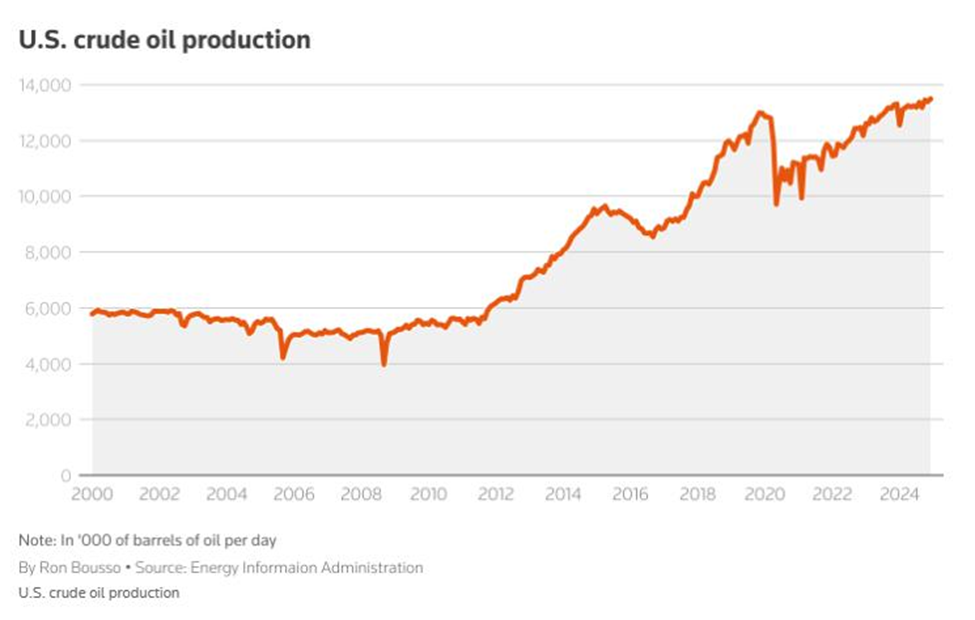

However, supplies from outside the group have increased dramatically, driven primarily by the United States, the largest oil producer in the world today. In 2024, the United States

produced 13.2 million barrels per day, more than Saudi Arabia’s output of about 9 million barrels per day.

As members such as Kazakhstan, Iraq, Nigeria, and the United Arab Emirates have expanded their production capability, the broader OPEC+ organization has also struggled within to maintain discipline.

As the number of electric vehicles has increased, internal combustion engines have gotten more efficient, and the use of oil in the heating and electricity sectors has decreased, producers also face slower growth in the demand for oil.

Saudi Arabia, the de facto leader of OPEC, is concerned about the deteriorating demand forecast. Aramco, the national oil corporation, announced on Tuesday that lower oil prices, reduced refining margins, and increased financing expenses would result in a 12% decline in net profit in 2024 and a 30% drop in total dividends to $85.4 billion in 2025.

Adding oil to a market that is already well-supplied would only make the situation worse and put additional strain on the Kingdom’s oil-dependent finances.

The budgetary needs of OPEC member nations, the growth of energy sources outside the club, and the possibility of declining oil consumption have all combined to make it impossible for OPEC to control the market as well as it once could.

The OPEC+ cuts have demonstrated that, with discipline, the cartel can effectively regulate supply.

It now seems impossible to imagine another instance of the 2014 market share war, in which Saudi Arabia, a very cheap producer, was able to flood the market with oil while hindering rising non-OPEC output.

On the other hand, the U.S.’s energy independence has allowed Washington to pursue policies that are in opposition to OPEC’s objectives.

All things considered, the Republican president is exploiting weaknesses that have been developing for years, which implies that the gradual power shift away from OPEC in energy markets is likely to continue regardless of the outcome of Trump’s protectionist policies.

Conclusion: The Power Shift is Here to Stay

The shifting power dynamics in the energy market have been brewing for years, but Trump’s actions and the broader geopolitical landscape have accelerated this change. As the U.S. solidifies its position as an energy powerhouse, it’s clear that OPEC’s ability to manage the global oil market is dwindling. Even if Trump’s protectionist agenda is put on hold, the long-term trend of diminished OPEC influence is likely to continue, marking a new era in the global energy market.

Until then, Happy Trading!

Commodity Samachar Securities

We Decode the Language of the Markets

Also Read: Trump’s Trade Wars, Tax Cuts & America’s Economic Future Focus , China Legislature Meets This Week: Key Decisions to Watch

Recommended Read: India’s Semiconductor Surge: Powering the Future of Electronics!

Want Help On Your Trades ?

Chat with RM