Crude oil Futures prices act like a swinging pendulum on Wednesday. Precisely, the prices of crude oil move down then again move up and up, and then could not resist the upward range and closed at the 6996 mark.

Furthermore, if we talk about today then the market opened with a green candle for crude oil prices. Currently, crude oil is trading at 6991 down by 0.07 percent.

There was a major dip in the inventory of crude oil which has already provided support to its prices. There was a fear of recession circulating all over the world. Moreover, the economy of China is deteriorating which thereby could be the most possible reason for the downfall in metal prices.

China considers being the largest industrial economy because of its massive manufacturing unit. Furthermore, all over the world, China consumes 40 percent of metal which led the country to be the largest industrial economy.

China is planning to offer a stimulus package to cure the economic health of the deteriorating country. Precisely, lending funds may somehow boost the economy which thereby gives strength to the crude oil prices in the days ahead. Presently, China is facing a challenge in economic growth, and safeguarding an economy is the topmost priority. Therefore, a shaking economy may damage the growth of the country.

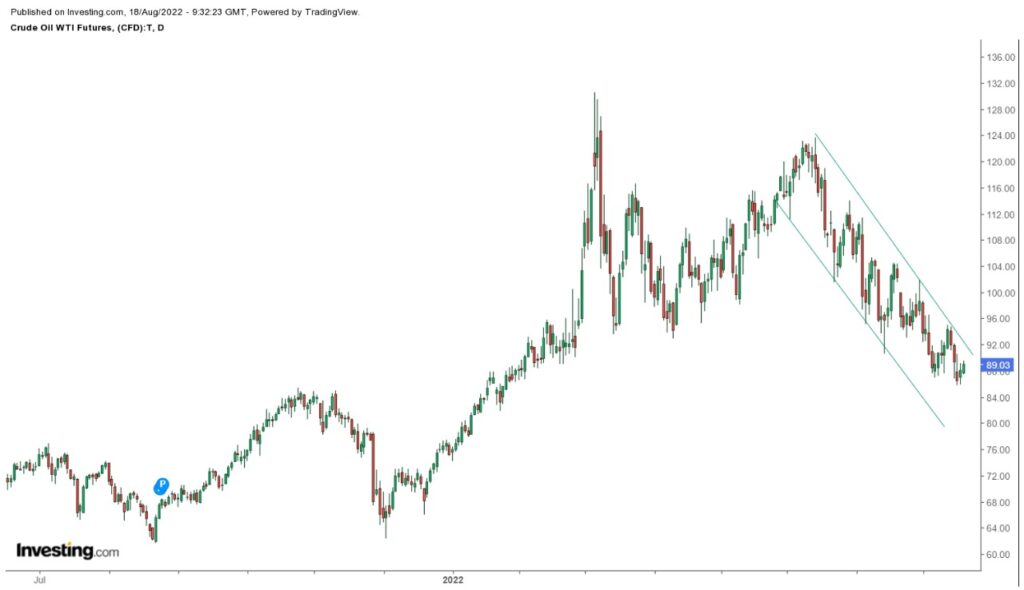

Technical Analysis on Crude Oil

Crude oil futures is forming a falling channel trend line pattern. Three consecutive close above $92 will take it to $103—$108 in days to come. Stop loss of $85 should be strictly maintained.

Technical Analysis on Natural Gas

Natural gas is trading in a resistance zone. If the level of $9.5 breaks then we may see upside level between $12—$13.50.

Today, we have the natural gas storage data at 08:00 PM. However, may impact the prices of natural gas lately.

For more regular updates, stay tuned with us…!!