Silver prices are trading slightly positive today. Prices turned neutral after steep losses over the past four weeks as traders awaited more cues on U.S. monetary policy while it reacted slightly after a Chinese interest rate cut missed expectations.

White metals snapped some losses after tumbling 7%, seeing some safe haven demand as slowing growth in China also weighed on sentiment. The People’s Bank of China largely missed market expectations with changes to its loan prime rate (LPR) on Monday.

Strong U.S. inflation and labor market readings had put pressure on bullions prices in recent weeks, as markets began pricing in a greater possibility of higher interest rates. Powell is now expected to shed more light on the bank’s plans for rates, after the minutes of the Fed’s July meeting showed that most policymakers supported higher rates to curb sticky inflation.

Furthermore, the dollar and treasury yield advanced on expectations of higher rate, also supported in negative sentiment.

This week, focus will shift on the Jackson Hole Symposium, scheduled on Thursday and Friday. The event will have to be watched closely as Federal Reserve Chair Jerome Powell is expected to offer more signals on the path of U.S. interest rates.

Technical View

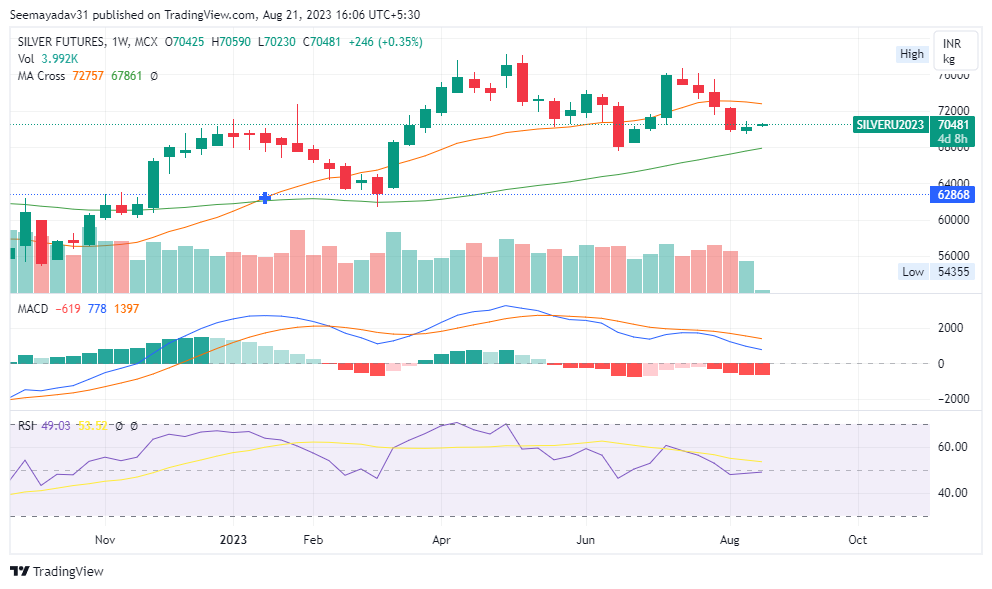

Silver prices have been traded in the negative zone since 17 July 2023. Prices retreated from the peak of 76674 and dropped towards 69376, which was last week low. Prices plunged more than 7%.

However, last week prices had an indecisive trade and were able to recover from the low of 69376 and settled at 70235.00 with minor gains of 0.37%.

Weekly price action resulted in formation of a hive wave candle stick which is indicating indecisiveness in near future. Although, prices are still trading above its July month low which is creating a probability for a bounce back from this level.

On the upside, immediate resistance is seen at 70920 a break above will expect to test next resistance 71400-72200.00. Traders may take long positions with stop loss 70200.

Alternatively, on the downside crucial support is seen at 69310 and a break below prices may retreat towards 68500-67900.