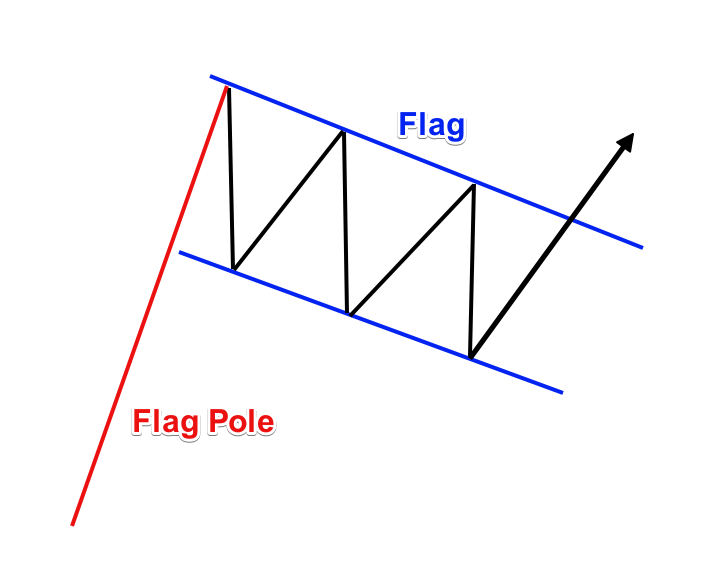

The white metal silver is shining radiantly thereby favoring bullish traders and this is a good time to invest in Silver. In the short-term chart, silver is forming a flag pattern that depicts a good risk-reward ratio. Precisely, a flag chart pattern comes with low risk and handsome profits. If we converse about technical analysis, then flag pattern is the most integral part of it. There are many successful traders who make a combination with other forms of technical analysis in order to maximize the chances of success. Basically, the flag is an entry outline that portrays the persistence of an established trend.

In the analysis of technical analysis, a flag is a price pattern that moves counter to the prevailing price trend as seen in a longer time frame on the price chart. It looks the same as a flag on a flagpole. The flag pattern is used to identify the possible continuation last trend from a point at which the price has rallied against that prevailing trend. Above breakout, the price increase could be rapid, making the timing of a trade advantageous by seeing the flag chart.

Let’s discuss Comex Silver Chart

Comex Silver chart resembles the same as in figure 1. Comex Silver is having a pole in the last few months and after that, there is a good consolidation in the last few weeks. Now Comex Silver is ready for a breakout for the upside target of $28.50—$30.00. Silver rallied during the Russia-Ukraine war and now consolidating in a range with negative bias after cooling down tensions up to an extent.

We are still not able to conclude that the global tension has come to end because the US is continuously creating sanctions on Russia and want other countries to support them. Except for the US, no other country is ready to ban Russia completely because Russia is the major exporter of oil and gas to Europe.

India is out of this war because of good relations with Russia, US, and all other countries. Russia is good enough to maintain its economy. Ruble bounced back sharply because Russia is playing a solid game on the global platform. Inflation is continuously rising because of escalating tensions. Europe is also facing issues because Russia dominating Ruble against the dollar in terms of trade. So global markets are in a dilemma but we know that price discounts everything.

Let’s discuss oscillator

Look at RSI (Relative strength index) as it gave a trend line breakout which shows strength in the daily chart also it retraces from lower levels and currently trading around 50.00. On the other hand, MACD is negative and we expect a healthy crossover after the breakout in Silver prices.

On the MCX division, Silver is too halted for a long time and currently trading at around 67000. The overall trend is positive in Silver too. INR will play a key role in MCX Silver. Silver is struggling to cross 68000—70500 levels. Once cross 70500 then there will be a good and healthy breakout. We suggest Indian traders and investors buy and accumulate Silver in panic as per your will and hold it for a medium to long term.

Recommendation

Here we suggest buying in Silver on a breakout above $25.00 on a daily closing basis with a stop loss below $23.50 for the upside target of 28.50—$30.00.