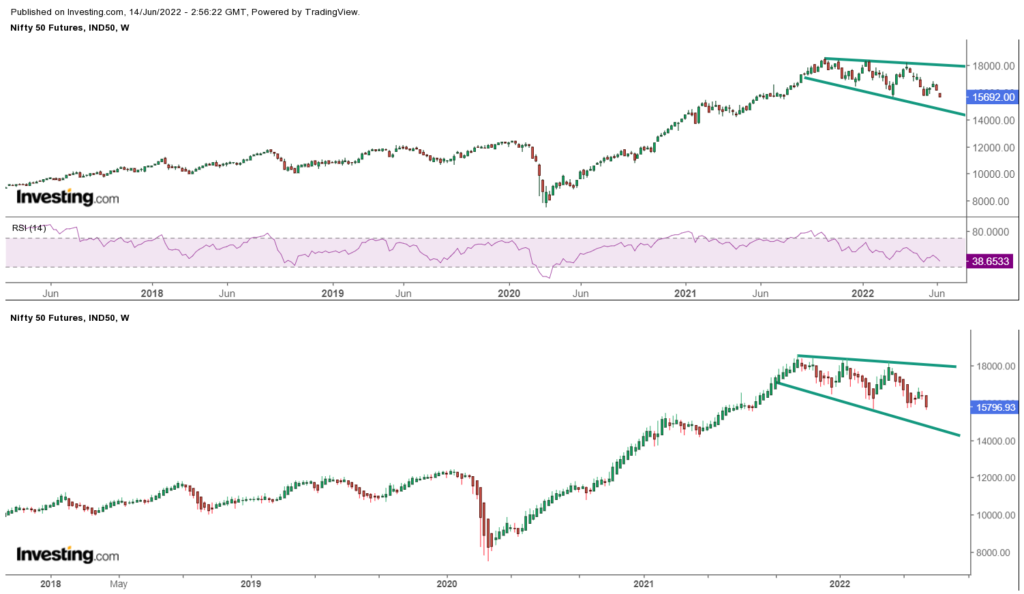

Slowly and gradually, the SGX Nifty is moving in the south direction and is likely to test its downside trendline support. Asian markets are in fear because of the expectation of interest rate hikes in the US.

Ongoing high inflation in the US as it recently tops 8.6% in the last 40 years. US debt has crossed 130% of total GDP which is the 2nd highest in the world. So many talks about recession in coming times but if this time recession came in the scenario then surely it won’t end for the next decade.

Not talking too much about that… Just keep an eye on the SGX Nifty

The market mood index is at 24.58 which is a good sign for investors. We will see a panic before Fed policy but chances are bright that the market may recover from lower levels again. Don’t be in a panic, soon we will get buying opportunities in it. Let the market mood index get deeper below 20 levels.

Option chain

Nifty PCR is at 0.70 and Maximum pain is at 16000. The option chain suggests that the market is in bearish mode and chances are bright for a sharp decline in the next 2–3 trading sessions.

On the other hand, FII’s selling their stocks continuously while DII ‘s able to manage all funds. That’s why the Indian market has not corrected too much. FII’s selling pressure may not impact too much in long run but definitely, it’s not a good sign for our economy. Rest when they will enter again then chances are bright that the market will recover again. As compared to the US economy, we are not that compatible but still, we are in the developing stage and have good economic growth.

Sunpharma

Trendline breakout on the weekly chart… Expect a downside target till 38.2% retracement of 721 and 50% retracement of 644

Be cautious around 870—900 levels. Stop-loss above 935 on a closing basis.