June 09, 2023 (Commodity Samachar) – In today’s news one of the first headlines that have arrived is with reference to Paytm. Paytm scales 9 months high with big volumes, likely to march towards INR 850. Paytm’s operator One97 Communications has given a string of bullish candlestick patterns on the daily charts. The stock has seen a strong gap up opening and has increased to more than 6 per cent and settled at INR 772. Overall things are progressing well for Paytm.

In other news, the mixed consumption trends in Q4 have been disclosed. The booking firm Jefferies in a recently released analysis confirmed that 40 major Indian consumer companies while disclosing their individual demand figures have noticed mixed trends across segments. The report suggests that recovery seems underway however, consumer demand has not yet picked up full-fledged.

Technical Outlook:

Nifty:

In the last session of Nifty, a strong move was witnessed toward the downward trajectory and formed an engulfing kind of candlestick pattern. We expect more downside in the following days.

Resistance is placed in 18780 followed by 18890. Support is placed at 18615 followed by 18530.

Our recommendation – Sell on the Rise

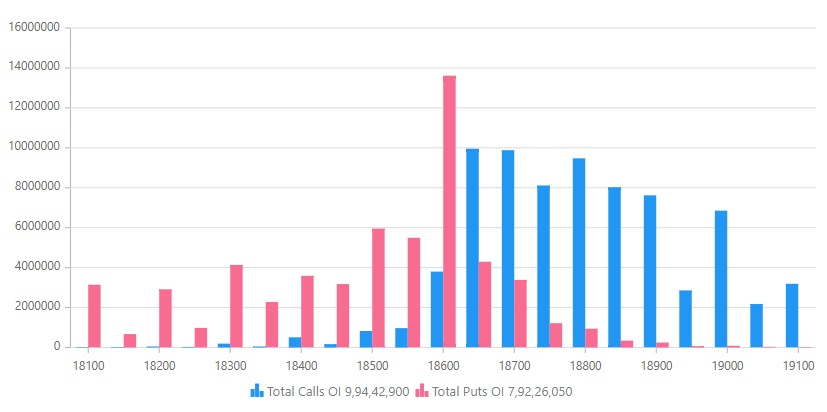

Nifty OI Analysis:

In the recent trading session, the Nifty Open Interest (OI) witnessed significant activity, with a total of 9.94 crore call options contracts in circulation. Among these call options, the 18,650 strikes took the lead with a staggering 1 crore contracts. Close behind was the 18,700 strike, displaying an impressive OI of nearly 97 lakh contracts. The 18,800 strikes also contributed significantly with an OI of 0.9 crore contracts.

Conversely, the put options in the Nifty displayed a total OI of 7.92 crore contracts. At the forefront was the 18,600 strike with a noteworthy 1.37 crore contracts. The 18,500 strikes followed suit with almost 60 lakh contracts, while the 18,550 strikes experienced a decline of 5.6 lakh contracts.

Bank Nifty:

On the last session of Bank nifty, a strong move in the downward trend was witnessed. This has directly formed an inverted hammer candlestick pattern. We expect more downside.

The resistance is placed at 44350 followed by 44480. Support was placed at 43780 followed by 43630.

Our recommendation is – Sell below 43910. Stop loss at 44500 and Target 43780/43630.

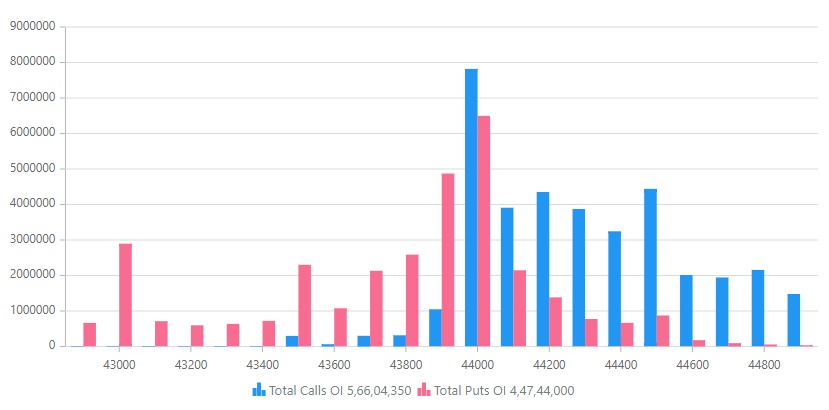

Bank Nifty OI Analysis:

Turning our attention to the Bank Nifty, the OI analysis revealed a total of 5.66 crore call options contracts. The 44,000 strikes claimed the highest OI with an impressive 77 lakh contracts, closely followed by the 44,500 strike which recorded a significant rise to 44 lakh contracts.

When it comes to put options, Bank Nifty displayed a total OI of 4.47 crore contracts. Once again, the 44,000 strikes stood out with an OI of 60.5 lakh contracts. Following closely behind were the 43,900 strikes with a substantial 40.9 lakh contracts.

FII and DII Data:

Foreign institutional investors (FIIs) bought shares worth Rs 212.40 crore, whereas domestic institutional investors (DIIs) sold shares worth Rs 405.01 crore on June 8, provisional data from the National Stock Exchange shows.

| Company Name | Corporate Action |

| Manorama Industries Ltd | Dividend |

| Raymond Limited | Fund Raising |