Friday’s Pick

SENSEX 4 OCT 82500PE RS.8,000/- (10 LOT)

BANKNIFTY 9 OCT 51500PE RS.6,000/- (10 LOT)

BANKNIFTY 9 OCT 51500CE RS.12,000/- (10 LOT)

NIFTY 10 OCT 25300PE RS.10,750/- (10 LOT)

SENSEX 4 OCT 82500CE RS.15,000/- (10 LOT)

NIFTY 10 OCT 25300PE RS.4,500/- (10 LOT)

ICICI BANK OCT 1250PE RS.5,600/- (10 LOT)

SENSEX 4 OCT 83000 PE RS.11,000/- (10 LOT)

NIFTY 10 OCT 25000 PE RS.8,750/- (10 LOT)

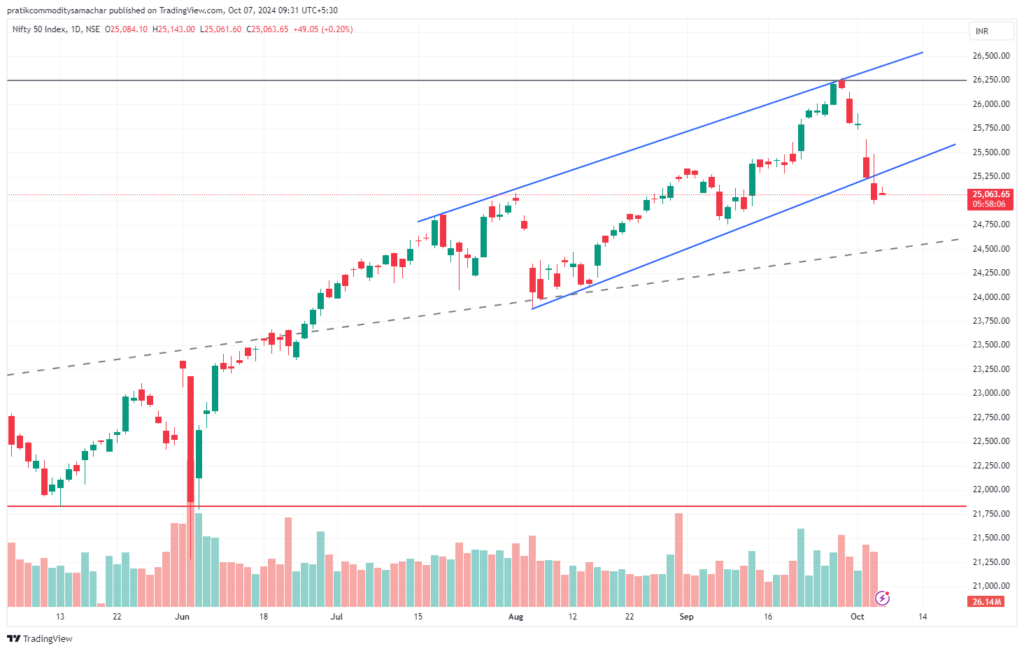

Nifty Technical View

The Nifty 50 dropped almost 5 percent from its record high, experiencing a 1 percent decline on October 4. For the first time in four months, the index closed below its 50-day Exponential Moving Average (EMA) with above-average trading volumes. Experts suggest that the overall trend favors bearish sentiment, indicating a “sell on rally” approach, although a rebound is still possible given the significant downtrend. The critical support level is 24,750, especially if the index closes below 25,000, while resistance is noted at 25,300 on the upside.

India Vix

Volatility continued its sharp upward trend for the second consecutive session, closing above the 14 level, which has unsettled bulls. If this level is maintained, it could further heighten their unease. The India VIX rose by 7.27 percent to reach 14.13, up from 13.17, following a previous rally of 9.86 percent.

FII And DII Data

During the past week, Foreign Institutional Investors (FIIs) were actively selling Indian stocks, divesting a substantial amount of Rs 40,512 crore in the cash market. In contrast, Domestic Institutional Investors (DIIs) were net buyers, acquiring Rs 33,074 crore.

Nifty PCR

The Nifty Put-Call Ratio (PCR), a gauge of market sentiment, fell to 0.69 on October 4, its lowest level since March 13, down from 0.88 in the previous session. An increasing PCR, particularly when it rises above 0.7 or exceeds 1, suggests that traders are selling more Put options than Call options, typically reflecting a bullish sentiment in the market. Conversely, if the ratio drops below 0.7 or approaches 0.5, it indicates that selling of Call options is outpacing that of Puts, signaling a bearish mood among traders.

Stocks To Watch

Titan Company: The Tata Group-owned jewellery and eyewear company reported a robust set of numbers in its business update for the quarter ended September 30, 2024. Titan Company registered a growth (standalone) of around 25% YoY in O2FY25. A total of 75 stores (net) were added during the quarter expanding Titan’s combined retail network presence to 3,171 stores. Its Jewellery segment grew 26% YoY.

Bandhan Bank: Total business of the private sector lender increased 24.6% in the second quarter of the current financial year. Total business at the end of September 30, 2024, touched ₹2,73,163 crore as compared to ₹2,19,712 crore in the similar previous period, representing a rise of 24.6%. Loans and advances of the bank at the end of current second quarter stood at ₹1,30,652 crore, while deposits touched ₹1,42,511 crore, the lender said.

Nifty and Bank Nifty Support and Resistance level

NIFTY :-

Resistance 25,353, 25,476, and 25,674

Support based 24,958, 24,835, and 24,637

BankNifty :–

Resistance : 52,109, 52,348, and 52,734

Support based : 51,336, 51,098, and 50,711

Index Future levels

Sell Nifty Futures Around 25,300 The suggested targets for this are 25,000 and 24,800 with the stop loss set Above 25,550.

Bank Nifty Sell Around 52,000 index is expected to downside levels of 51,800 and 51,600 and level 52,250 will act as a stop loss.

Momentum Pick: CENTURY TEXTILES LTD

Buy above ₹2885 | Target price: ₹ 3000/3050 |Stop Loss:₹ 2700

Century Textiles and Industries Ltd has transformed from a single-unit textile entity in 1987 into a commercial powerhouse with interests in diverse industries. Currently, the business house is a trendsetter in cotton textiles and also has a remarkable presence in the Pulp and Paper and Real Estate sectors. This was the first business started by the company in 1897. It is World’s 2nd and India’s 1st LEED V4 certified Textile Mfg. Co. Today, Birla Century leads the textiles market with its premium cotton textiles products.

In FY 24, Company’s Profit was ₹7.78 crore, which was an increase from the previous fiscal year’s loss of ₹5.88 crore Revenue increased by 2.86%, EPS was ₹1.65, which was a 49.04% decrease from the previous, The market cap was ₹24,501.82 crore. The 52-week high was ₹2,420 and the low was ₹905.1, Collections increased by 32% year-on-year to ₹488 crore. The company’s paper business is considered a cash cow, and commercial projects provide a steady cash flow each year.

Happy Trading!

Commodity Samachar Securities

We Decode the Language of the Markets

Also Read: US Non-Farm Payroll data is expect to drag volatility Silver Price Soars Amid Mid-East Tensions: Will It Break?

Recommended Read: MCX Commodities Uncovered: The Must-Knows and Essential Insights [2024]

Want Help On Your Trades ?

Chat With RM