Yesterday’s Pick:

RECLTD 25APR24 460 CE BUY 20.50 to 23

ABCAPITAL 25APR24 180 CE 6 to 7

Nifty Technical View:

The emergence of a Doji formation at new highs or following a substantial uptrend often hints at market indecision. This uncertainty could lead to a temporary consolidation or a minor dip from the current elevated levels. However, considering the prevailing positive chart pattern, such price movements could serve as favourable entry points for traders and investors. Despite the possibility of a short-term pullback, the overarching bullish trend suggests that the market is poised for further upside potential. Anticipating a breakout beyond the 22,500 level, with a short-term target around 22,800 for the Nifty index, underscores the optimism in the market sentiment.

Indian Vix :

Throughout the day, market volatility decreased significantly, favouring bullish investors. The India VIX, reflecting market fear, dropped by 5.84 percent to 12.08, its lowest level since December 13, 2023. This decline suggests reduced uncertainty among investors, fostering a positive market sentiment and potentially strengthening bullish trends.

Nifty and Bank Nifty Support and resistance level:

Nifty :- Resistance 22,530 , 22,575 and 22680 levels.

Support 22,410, 22,371 and 22,200 levels.

Bank Nifty: Resistance 47,603, then 47,790 and 48,000.

Support 47,400 followed by 47,190 and 47,100..

Index Future levels

Nifty Futures Buy above 22400. The suggested targets for this are 22,600 and 22,700, with a stop loss set at 22,240 .

Bank Nifty future Buy above 48,000 , the index is expected to see upside levels of 48,200 and 48400, and level 47,760 will act as a stop loss.

Stocks in the news:

Ashok Leyland: The commercial vehicles maker has recorded a 4 percent on-year decline in total vehicle sales at 22,866 units, with domestic sales falling 7 percent to 21,317 units during the same period. The medium and heavy commercial vehicle sales dropped 7 percent YoY to 15,562 units in March 2024.

Below 173 we may see weakness in above mentioned stock.

Todays top pick :

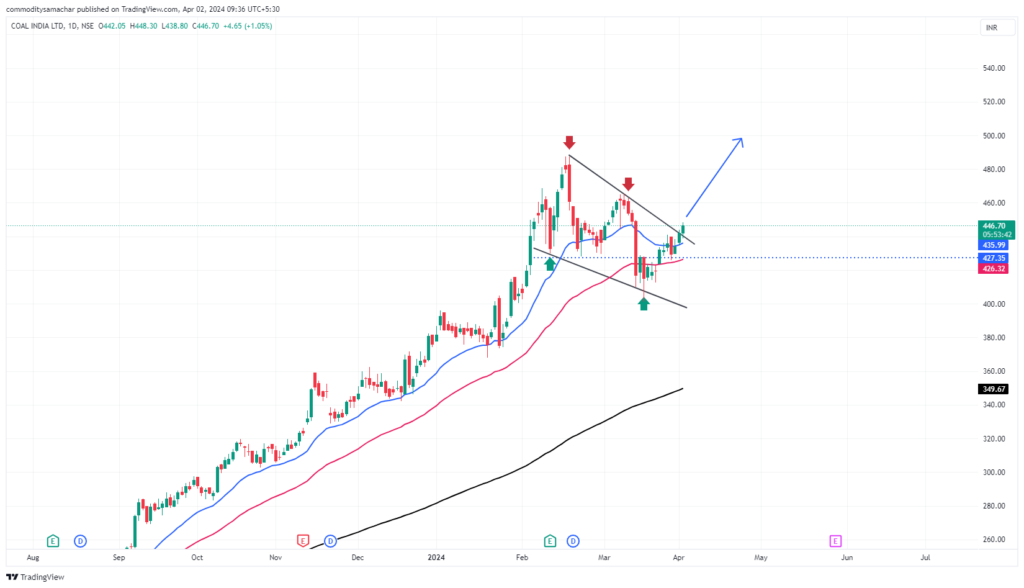

COALINDIA : BUY 445| Target 464| Target 483| Stop Loss 423

Coal India Ltd is mainly engaged in mining and production of Coal and also operates Coal washeries. The major consumers of the company are power and steel sectors. Consumers from other sectors include cement, fertilizers, brick kilns etc.

Coal India Ltd has achieved a revenue of Rs.36,154 crs, registering a growth of 3% YoY during Q2FY24. Coal India 17 % increase in its consolidated net profit, amounting to ₹9,069 crore for the quarter ending on December 31, 2023, compared to ₹7,755 with stable promoters holding 63.13%, FII holdings 8.60% and DII 23.06%.

Coal India’s (CIL) coal supplies to thermal power plants of the country hit 610.8 million tonnes (MTs) on Wednesday surpassing the annual target of 610 MTs to this sector. This was highest to date and the company achieved the feat four days earlier than the FY 2024 closure.

Technical Outlook:

Coal India’s stock seems to be showing signs of a potential uptrend. There’s a chance it might break out of its downward trend (falling channel), especially if it stays above the key level of 445, indicating increased buying interest. Additionally, closing above its 21-day moving average suggests positive momentum in the short term.

Commodity Samachar

Learn and Trade with Ease

Also Read: US NFP And European CPI Incoming. A Prelude To Rate Cut Bets?, Nifty Breaches Key Level: Can the Bull Charge Continue?

Recommended Read: Going ‘All In’ for ‘Made in India’: What’s the Buzz Among American Consumers ?