Yesterday’s Pick

BANKEX 23 SEP 61000 CE RS.15,000/- (10 Lot)

BHARTI AIRTEL LTD SHORT TREM PICK ( 3% Return ) RS.5,500/- (100 Quantity)

BANKNIFTY SEP 54000CE RS. 22,500/- ( 10 Lot)

DEVYANI INTERNATIONAL LTD (11% Return) RS.10,500/- (100 Quantity)

Nifty Technical View

The market maintained its upward momentum, with benchmark indices reaching new record highs on September 23. The Nifty 50 jumped 148 points to close at a fresh peak of 25,939, marking its third consecutive session of higher highs and lows. Analysts believe the bulls could push the index past the 26,000 level soon, with the next resistance point set at 26,200. However, if it struggles to break through that, the index might enter a consolidation phase, finding immediate support at 25,800 and critical support at 25,500.

India Vix

Volatility spiked significantly, continuing its upward trend and nearing the 14 mark during the day. As long as it remains below 15, the outlook may still be positive for the bulls. The India VIX, also known as the fear index, surged 7.78 percent to reach 13.79.

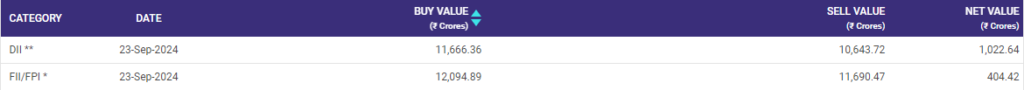

FII And DII Data

On September 23, Foreign institutional investors purchased Indian stocks worth ₹1,022.64 crore, while Domestic institutional investors bought stocks totaling ₹404.42 crore.

Nifty PCR

Nifty Put-Call Ratio (PCR) dropped to 1.42 from 1.5, signaling a shift in market sentiment. A PCR above 0.7, especially over 1, suggests traders are selling more Put options, indicating bullish sentiment. Conversely, if the ratio falls below 0.7 or nears 0.5, it shows higher Call selling, reflecting a bearish outlook.

Stocks to Watch

Punjab National Bank

The bank opened its Qualified Institutions Placement (QIP) issue on September 23, with a floor price of Rs 109.16 per share. According to CNBC-TV18, quoting sources, the base size of the QIP is Rs 2,500 crore, with a green shoe option of Rs 2,500 crore.

Coal India

The state-run coal mining company has signed a joint venture agreement with Rajasthan Rajya Vidyut Utpadan Nigam (RRVUNL) for setting up a 2×800 MW brownfield thermal power project at RRUVNL’s existing Kalisindh Thermal Power Station. Coal India will hold a 74% stake in the joint venture, with the remaining 26% held by RRVUNL.

Nifty and Bank Nifty Support and Resistance level

NIFTY :-

Resistance 25,950, 25,980, and 26,050

Support based 25,900, 25,850, and 25,800

BankNifty :–

Resistance : 54,200, 54,300, and 54,500

Support based 53,850, 53,750, and 53,550

Index Future levels

Nifty Futures Buy Around 25,800 The suggested targets for this are 25,900 and 26,100 with the stop loss set at 25,600

Bank Nifty Buy Above 54,000 index is expected to upside levels of 54,200 and 54,400 and level 53,800 will act as a stop loss.

Momentum Pick: HINDUSTAN COPPER LTD

Buy above ₹ 330| Target price: ₹ 380/400 |Stop Loss:₹ 300

Incorporated in the year 1967, Hindustan Copper Limited (HCL) was formed to take over from National Mineral Development Corporation Ltd. It is the first Indian PSU and only vertically integrated copper producing company. HCL is engaged in various processes right from copper mining to the final stage of converting copper into saleable products. It is a only Indian Company mining Copper Hindustan Copper Limited(HCL) is the only Public sector undertaking which is engaged in producing Copper right from mining to benefication, smelting, refining, casting of refined copper metal and converting into saleable products.

In FY 24-25, For the June quarter, Hindustan Copper’s net profit surged to ₹113 crore from ₹47 crore last year. This, despite higher employee expenses, power and fuel costs and lower other income. The bottom-line was aided by an increase in revenue, which grew by 33% from the same period last year to ₹493.6 crore.

Happy Trading!

Commodity Samachar Securities

We Decode the Language of the Markets

Also Read: Indian Rupee Hits 2-Month High: Is the Rally Here to Stay?

Recommended Read: MCX Commodities Uncovered: The Must-Knows and Essential Insights [2024]

Want Help On Your Trades ?

Chat With Analyst