Gold prices sparked for the third consecutive day yesterday. Prices jumped by 0.64%, and settled above 59300. Fed rate policy speculation, falling dollar and jitters of a potential banking crisis put the yellow metal on course for a sharp rise this month.

Gold prices shot up through March as fears of a banking crisis saw investors pile into traditional safe haven assets, chiefly the yellow metal.

While government intervention now appears to have stemmed the possibility of a bigger lending crisis, the collapse of several U.S. banks saw investors begin pricing in a less hawkish Fed, on bets that the central bank will try to avoid more pressure on the economy.

Thursday’s unemployment claims data also factored into this trend, given that the central bank said it was also targeting some cooling in the employment space. Metal markets rallied on Thursday.

The dollar slid on Thursday and was muted in Asian trade, which further supported non-yielding assets. U.S. Treasury yields also retreated. U.S. dollar fell to a 1-week low against the euro and as concerns over the banking sector receded, continued supporting in upside momentum.

Furthermore, today a bunch of economic data and events are scheduled to be released, which will influence the entire market. Some among them Europe Inflation and US Core PCE Price Index m/m will lead extreme volatility.

Technical Outook

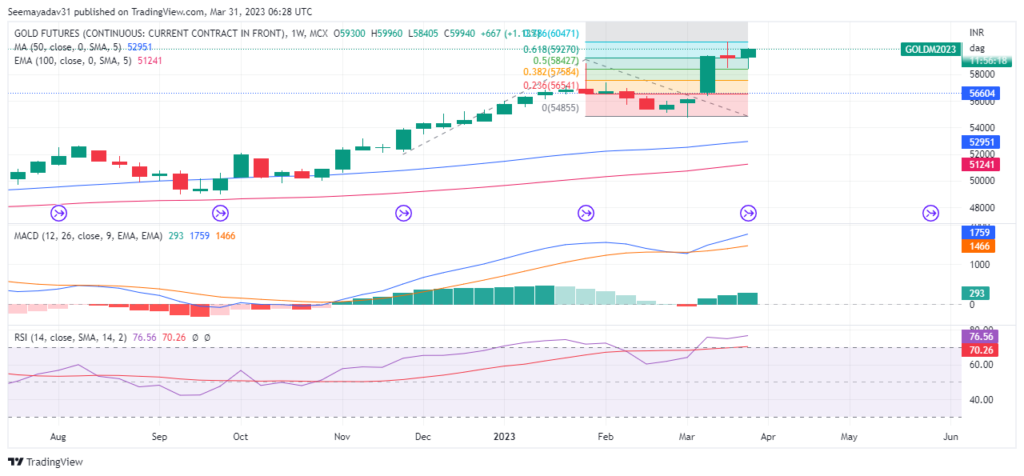

Our weekly outlook has proven accurate. Gold prices rebounded from the dip 58550-58405 and jumped above first projected target 59500, cmp 59995, almost reaching near to second target 60000.

Since the start of the week GOLD prices soared by 1.12%. It made a low of 58405 and jumped towards 59995. However, it traded below its last week high of 60455 that was life lifetime high.

On the above chart, prices rebounded sharply from previous week low. It breached 50% Fibonacci Retracement. This is creating a probability for upside momentum towards next resistance 61.8% Retracement. The revised projected target would be 60500-60650 level.

Hence, it’s expected that bullish momentum will continue. However after an abrupt rally, prices may consolidate or take a temporary dip towards 59400-59300 again before the next bullish move. Or, if prices break 60050 then will open the door for 60250-60500-60650.Immediate stop loss will be at 59780.00

Alternatively, on the downside immediate support is seen at 58500. And a break below it prices may retreat towards 58000-57650.