The Bank of Japan’s decision to raise its interest rate to 0.5% today led to a sharp spike in gold price, pushing MCX Gold to an all-time high. This reaction underscores gold’s sensitivity to global monetary policy changes, as higher Japanese rates typically weaken the yen, prompting increased demand for gold as a hedge.

Interestingly, despite this surge, COMEX Gold remains below the significant psychological level of $3,000. The recent inauguration of President Trump introduces an additional layer of political uncertainty, further complicating gold’s trajectory. Historically, gold’s performance often correlates with market sentiment and geopolitical developments, which makes this period particularly unpredictable.

From a technical perspective, the recent rally in MCX Gold and COMEX Gold indicates potential overbought conditions, hinting at a scope for a near-term correction. Momentum indicators suggest that while bullish sentiment remains intact, profit booking at higher levels could trigger a temporary pullback. However, sustained demand driven by inflation fears and currency fluctuations might limit the extent of this correction.

In conclusion, while $3,000 on COMEX Gold appears elusive in the current scenario, the market’s focus will remain on geopolitical developments and central bank policies. Traders should closely monitor key support and resistance levels for potential opportunities.

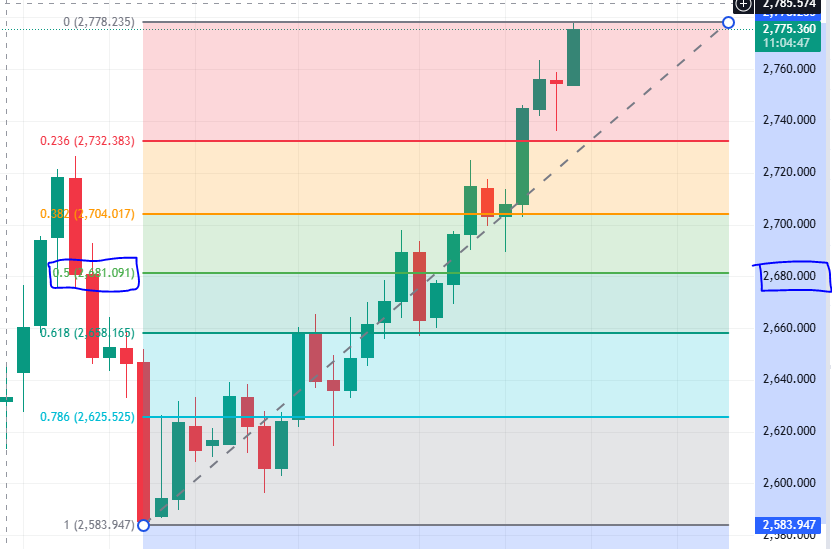

Analysing XAUUSD, it is observed that the swing high established on December 19th remains unbroken. Over the last two days, there has been a closing below $2757, which served as a strong resistance level, previously marked by two shoulders formed in October 2024. If gold retraces to $2788 and breaks the current swing, a decline toward $2682 becomes plausible. This level could act as a support, potentially revitalizing bullish momentum and enabling gold to achieve new highs.

In conclusion, while $3,000 on COMEX Gold appears elusive in the current scenario, the market’s focus will remain on geopolitical developments and central bank policies. Traders should closely monitor key support and resistance levels for potential opportunities.

Until then, Happy Trading!

Commodity Samachar Securities

We Decode the Language of the Markets

Also Read: Spotlight: Will Crude Oil Price Shift with Trump’s Plan? , Gold Price Spotlight: How Trump’s Tariffs Fueled a Boom

Recommended Read: 2024 G20 Summit: Did It Deliver on Market Expectations?

Want Help On Your Trades ?

Chat with RM