On Friday, January 10, 2025, gold prices saw a modest increase during Asian trading hours, driven by heightened uncertainty surrounding U.S. interest rates and trade tariffs that prompted increased demand for safe-haven assets. Spot gold rose 0.1% to $2,672.12 per ounce, while February futures climbed 0.2% to $2,695.74 per ounce. This week, gold is on track for a gain of approximately 1.5%, reflecting the growing economic unease.

However, the strength of the U.S. dollar and hawkish signals from the Federal Reserve limited significant gains in gold prices. Market participants were particularly anxious ahead of the nonfarm payrolls data scheduled for later in the day, which is expected to influence the outlook for U.S. interest rates. Historically, this data has consistently surpassed expectations over the past year, indicating a resilient labor market that might provide the Fed with more flexibility regarding future rate cuts.

The minutes from the Fed’s December meeting revealed that policymakers are cautious about further interest rate reductions due to persistent inflation and a robust labor market. Additionally, concerns were raised about inflationary pressures stemming from protectionist and expansionary policies under President-elect Donald Trump, with uncertainty expected to grow as his inauguration approaches on January 20.

In addition to gold, other precious metals also experienced gains on Friday. Platinum futures increased by 0.9% to $993.20 per ounce, while silver futures rose 0.5% to $31.160 per ounce.

Turning to industrial metals, copper prices continued their upward trend as weak economic data from China fueled speculation that the Chinese government would significantly ramp up stimulus efforts in 2025. Benchmark copper futures on the London Metal Exchange rose 0.5% to $9,123.50 per ton, with March copper futures also climbing 0.5% to $4.3355 per pound.

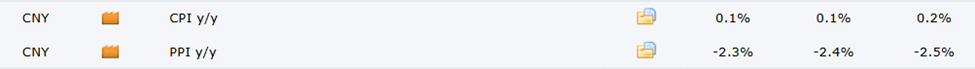

Weak inflation figures released from China have led many to believe that Beijing will need to implement more fiscal measures aimed at boosting private spending in response to ongoing economic challenges. The potential for increased U.S. trade tariffs is further expected to prompt China to deploy additional stimulus in an effort to safeguard its economy amidst prolonged sluggish growth.

As the world’s largest copper importer, China’s economic performance remains a critical factor influencing global copper prices, with ongoing concerns about demand due to its current economic struggles.

Until then, Happy Trading!

Commodity Samachar Securities

We Decode the Language of the Markets

Also Read: Crude Oil Prices Drop—Winter Demand to Change the Game? , Gold Shines Bright While Silver Fights Right!

Recommended Read: 2024 G20 Summit: Did It Deliver on Market Expectations?

Want Help On Your Trades ?

Chat with RM