Friday’s Pick

NIFTY SEP 25500PE 50 POINTS🚀 Profit : 12500+ PER 10 LOTS

BANKNIFTY SEP 53500CE 100 POINTS🚀 Profit : 15000+ PER 10 LOTS

SENSEX 20 SEP 83000PE 40 POINTS🚀 Profit : 4000+ Per 10 Lot

SENSEX 20 SEP 83500CE 230 POINTS🚀 Profit : 23000+ Per 10 Lot

BANKNIFTY SEP 53500PE 30 POINTS🚀 Profit : 4500+ Per 10 Lot

JUBILIANT FOODWORK LTD 27 POINTS(200 QUANTITY) PROFIT: 5400+ 3.5% RETURN

SHORT TREM PICK ITD CEMENTATION LTD (200 QUANTITY) PROFIT: 3600+ 3.5% RETURN

Nifty Technical View

On September 20, the benchmark index Nifty 50 experienced a strong rally, closing at a new high of 25,791, up 375 points. The index surpassed the rising resistance trendline, supported by positive momentum indicators like the RSI and MACD. This reinforces a positive trend, with the next key resistance level at 26,000, expected during the monthly F&O expiry week. However, some consolidation may occur first, with support identified at 25,500.

India Vix

Volatility increased slightly following a sharp decline but remained relatively low and below all key moving averages, which is a positive indicator for bullish sentiment. The India VIX, or fear index, rose by 2.57% to 12.79, up from 12.47.

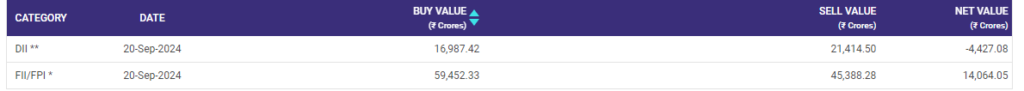

FII And DII Data

FIIs have maintained a strong presence with a majority of long positions in the index futures segment. Towards the end of the week, this trend continued, reflecting confidence in the market outlook. Foreign institutional investors (FIIs) were quite active, making substantial purchases of Rs 14,000 crore on Friday alone, While domestic institutional investors sold stocks worth ₹4,427 crore.

Nifty PCR

The Nifty Put-Call ratio (PCR) rose to 1.5 on September 20, indicating a stronger bullish sentiment in the market. This is because traders are buying more Call options (bets on the market going up) than Put options (bets on the market going down). When the PCR is above 1, it generally suggests a bullish market mood.

Stocks To Watch

HDFC Bank: HDB Financial Services (HDBFS), a subsidiary of HDFC Bank, is set to list its equity shares, including a fresh issue of up to ₹2,500 crore and an offer for sale by existing shareholders. In the June quarter, HDBFS posted a 2.6 percent year-on-year growth in net profit to ₹580 crore, with its loan book expanding 30 percent to ₹95,600 crore.

Vodafone Idea: The company faces financial pressures following the Supreme Court’s ruling on AGR dues. An unexpected investor meeting is scheduled to discuss the latest developments. Vodafone Idea has also inked a three-year, $3.6 billion deal with Nokia, Ericsson, and Samsung to expand its 4G and upcoming 5G network.

Nifty and Bank Nifty Support and Resistance level

NIFTY :-

Resistance 25,830, 25,950, and 26,150

Support based 25,550, 25,420, and 25,250

BankNifty :–

Resistance : 53,900, 54,250, and 54,650

Support based 53,250, 53,000, and 52,600

Index Future levels

Nifty Futures Buy At 25,800 The suggested targets for this are 26,000 and 26,100 with the stop loss set at 25,600

Bank Nifty Buy Above 53,600 index is expected to upside levels of 53,900 and 54,200 and level 52,950 will act as a stop loss.

Momentum Pick: POWER GRID CORP. LTD

Buy above ₹ 340| Target price: ₹ 355/370 |Stop Loss:₹ 330

Power Grid Corporation of India Limited is a Maharatna CPSU and India’s largest electric power transmission company. GoI holds a 51.34% stake in the company as on March 31, 2021. PGCIL was incorporated in 1989 to set up extra-high voltage alternating current and high-voltage direct current (HVDC) transmission lines. The company moves large blocks of power from the central generating agencies and areas that have surplus power to load centres within and across regions. It is under the administrative control of the Ministry of Power, GoI. PGCIL also executes several strategically important projects, assigned to the company by GoI on nomination basis. Power Grid Corporation of India is principally engaged in planning, implementation, operation and maintenance of Inter-State Transmission System (ISTS), Telecom and consultancy services.

Power Grid Corporation of India Ltd’s revenue jumped 0.45% since last year same period to ₹11,308.61Cr in the Q1 2024-2025. On a quarterly growth basis, Power Grid Corporation of India Ltd has generated -8.56% fall in its revenue since last 3-months. Power Grid Corporation of India Ltd’s net profit jumped 3.52% since last year same period to ₹3,723.92Cr in the Q1 2024-2025. On a quarterly growth basis, Power Grid Corporation of India Ltd has generated -10.62% fall in its net profits since last 3-months.

Happy Trading!

Commodity Samachar Securities

We Decode the Language of the Markets

Also Read: Unveiling Surprising Trends in Silver Price Fluctuations

Recommended Read: GDP : Is it an important aspect that you should focus on?

Want Help On Your Trades ?

Chat with RM