Yesterday’s Pick

BANKNIFTY 18 SEP 52000CE 140 POINTS🚀 Profit : 14000+ PER 10 LOTS

BANKNIFTY 18 SEP 52500CE 220 POINTS🚀 Profit : 33000+ PER 10 LOTS

NIFTY 19 SEP 25400CE 60 POINTS🚀 Profit : 15000+ Per 10 Lot

HDFCBANK 1700 CE SEP 6 POINTS🚀 Profit : 3300+ Per 1 Lot

BANKNIFTY 18 SEP 53000CE 40 points 🚀 Profit : 6000+ PER 10 LOT

TORRENTPOWER SHORT TREM PICK 9% RETURN(50 QUANTITY)🚀 PROFIT: 7750+

HEG LTD SHORT TREM PICK 10% RETURN(50 QUANTITY)🚀 PROFIT: 12100+

GRAPHITE INDIA LTD SHORT TREM PICK 10% RETURN(200 QUANTITY)🚀PROFIT: 10800+

BANKNIFTY SEP FUTURE 350 POINT🚀 PROFIT: 5250+ PER 1 LOT

SBIN BANK SEP FUTURE 5 POINTS🚀PROFIT: 3750+ PER 1 LOT

Nifty’s Technical View

Market participants opted for minor profit-taking ahead of a significant event the results of the US Federal Reserve’s monetary policy meeting. The US central bank cut the benchmark interest rates by 50 basis points, bringing them to a range of 4.75% to 5.00%. On September 18, the Nifty 50 declined by 41 points to settle at 25,378, experiencing some volatility. The 25,500 mark is anticipated to be a key resistance level, while a potential rise toward 25,800 is within reach. Immediate support is identified at 25,300, with the crucial level lying at 25,000.

India Vix

Volatility continued its upward trend for another session, increasing sharply but still staying at lower levels, which benefits bullish sentiments. The India VIX, a measure of market anxiety, rose by 6.22% to 13.37. As long as it remains below the 15 threshold, the trend is likely to support the bulls.

Nifty PCR

The PCR, a measure of market sentiment, decreased to 1.13 on September 18 from 1.3 the day before.

A PCR above 0.7 or 1 suggests that traders are buying more Call options than Put options, indicating a bullish market outlook. Conversely, a PCR below 0.7 or approaching 0.5 indicates that traders are buying more Put options than Call options, suggesting a bearish market outlook.

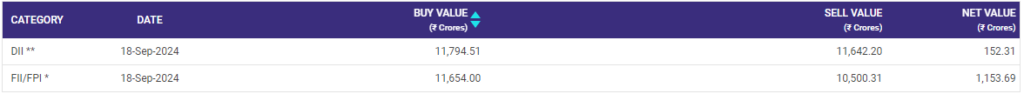

FII And DII Data

On September 18th, foreign institutional investors acquired Indian stocks worth ₹1,153.69 crore, while domestic institutional investors purchased stocks totaling ₹152.31 crore.

Stocks To Watch

SBI: State Bank of India (SBI) raised ₹7,500 crore by issuing Basel III-compliant Tier 2 bonds to qualified institutional bidders. The issue attracted an overwhelming response, with bids exceeding 3 times the base issue size of ₹4,000 crore. The wide range of investors included provident funds, pension funds, mutual funds, and banks. SBI Chairman C S Setty noted that the strong participation reflected the trust investors have in India’s largest bank.

NTPC: NTPC will be a key stock to watch as it prepares to list its renewable energy subsidiary. The company aims to raise approximately ₹10,000 crore through the green energy IPO, and the draft papers for the listing have already been submitted.

BHEL, PFC: BHEL has paid a final dividend of ₹55 crore to the government, while Power Finance Corporation (PFC) reported a record dividend payout of ₹4,455 crore for 2023-24, with ₹462 crore going to the government.

Nifty and Bank Nifty Support and Resistance level

NIFTY :-

Resistance 25,480, 25,700 and 26,180

Support based 25,300, 25200 and 24,800

BankNifty :–

Resistance :53,100, 53,250 and 54,000

Support based 52,300, 51,750, and 51,500

Index Future levels

Nifty Futures Buy At 25,500 The suggested targets for this are 25,650 and 25,750 with the stop loss set at 25,300

Bank Nifty Buy Above 52,800 index is expected to upside levels of 53,150 and 53,350 and level 52,350 will act as a stop loss.

Momentum Pick: SYMPHONY LTD

Buy above ₹ 1490 | Target price: ₹ 1560/1600 |Stop Loss:₹ 1435

Symphony was established in 1988, in Ahmedabad, India. The company is engaged in the manufacturing and trading of residential, commercial, and industrial air coolers in the domestic and international markets. It is the largest air cooler manufacturer in the world, 97% of the revenue comes from the sale of Air coolers.

In FY24-25, Symphony Ltd’s revenue jumped 69.81% since last year same period to ₹540Cr in the Q1 2024-2025. On a quarterly growth basis, Symphony Ltd has generated 58.36% jump in its revenue since last 3-months. Symphony Ltd’s net profit jumped 266.67% since last year same period to ₹88Cr in the Q1 2024-2025. On a quarterly growth basis, Symphony Ltd has generated 83.33% jump in its net profits since last 3-months. Symphony Ltd’s net profit margin jumped 115.93% since last year same period to 16.30% in the Q1 2024-2025. On a quarterly growth basis, Symphony Ltd has generated 15.77% jump in its net profit margins since last 3-months.

Happy Trading!

Commodity Samachar Securities

We Decode the Language of the Markets

Also Read:Economic News: US Federal Reserve Decision in Focus Today

Recommended Read: GDP : Is it an important aspect that you should focus on?