Imagine a DJ at a party—too loud, and people leave; too soft, and the vibe dies. Now, replace that DJ with the Reserve Bank of India (RBI) and the economy as the dance floor. RBI fine-tunes the beats (a.k.a. monetary policy) to ensure that inflation doesn’t ruin the party and growth doesn’t get too sluggish.

Let’s break it down from basics to boss level and check out what’s hot in RBI’s latest policy moves!

Monetary Policy 101: The RBI’s Rulebook

RBI’s monetary policy = Money supply + Interest rates + Inflation control. It sets the pace for borrowing, lending, and overall economic health.

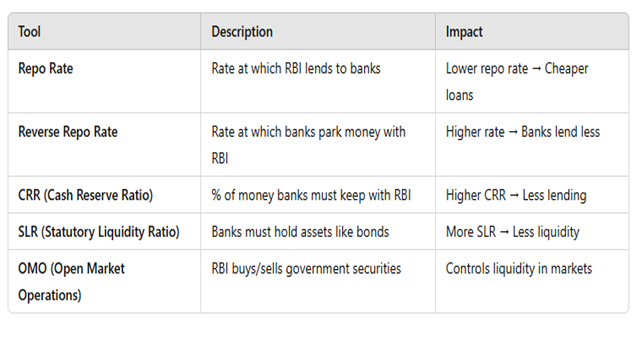

Money supply includes all the cash, bank deposits, and liquid assets circulating in the system. RBI controls it using tools like CRR (Cash Reserve Ratio) and OMO (Open Market Operations) to ensure there isn’t too much (causing inflation) or too little (slowing growth)

A high repo rate makes borrowing expensive, slowing inflation but cooling down growth. A low repo rate makes loans cheaper, boosting spending and investment but risking inflation.

Inflation means rising prices, and while some inflation is normal, too much of it weakens purchasing power. RBI’s target is 4% ± 2%, and it tweaks interest rates and liquidity to keep inflation in check.

Key Tools in RBI’s Toolbox

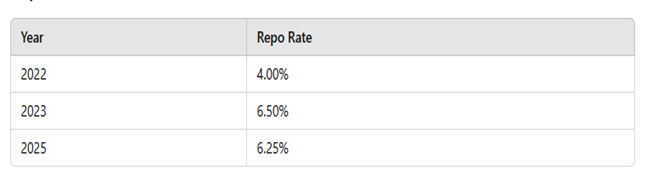

Repo Rate Over Time

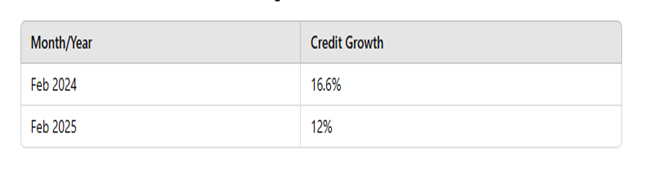

India’s Credit Growth (YoY % Change)

The drop in credit growth from 16.6% (Feb 2024) to 12% (Feb 2025) signals reduced loan demand, likely due to higher interest rates impacting borrowing costs. This slowdown can indicate tightening financial conditions, possibly affecting consumption and investment, which are critical for economic expansion.

Foreign Investment Surge

A rise in foreign holdings in Indian equities from 22% to over 25% by 2026 indicates growing confidence among global investors in India’s economic and market potential. This surge in foreign investment can lead to higher liquidity, improved market depth, and stronger price discovery in Indian stocks. Increased FII (Foreign Institutional Investor) participation typically drives bullish momentum, benefiting large-cap and fundamentally strong stocks the most. However, higher foreign ownership also makes markets more sensitive to global factors, meaning any geopolitical tension or interest rate hikes in the US could trigger outflows. Overall, this trend reflects India’s strengthening position as an attractive investment destination, but domestic investors must remain cautious about external dependencies.

India’s Monetary Policy Revolution: Inflation Targeting

In 2016, India adopted Flexible Inflation Targeting (FIT), meaning RBI must keep inflation at 4% (+/- 2%). The Monetary Policy Committee (MPC) was introduced to make rate decisions more transparent and reduce government interference.

RBI’s Latest Moves in 2025: Rate Cut, Liquidity Game & Investment Boom

February 2025 Update

- RBI cut the repo rate by 25 bps to 6.25%, marking the first cut in 5 years to boost growth & counter the global economic slowdown.

March 2025 Update

- RBI pumped $10B into the banking system via a USD/INR swap to increase liquidity.

April 2025 Teaser

- RBI is doubling foreign investor limits in Indian stocks from 5% to 10%, which could lead to increased foreign capital in Indian markets.

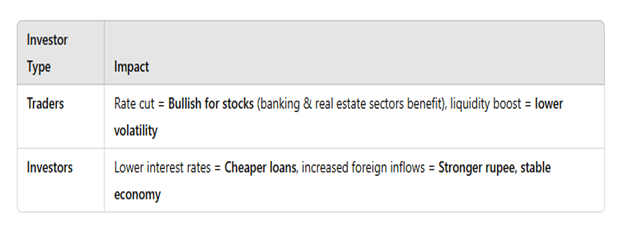

What It Means for You – Traders & Investors

Final Take: RBI’s 2025 Playbook is Looking Strong

RBI’s 2025 playbook looks well-aligned for economic growth, with a rate cut, increased liquidity, and a boost in foreign investments working in tandem. The rate cut makes borrowing cheaper, encouraging businesses to expand and consumers to spend more, which fuels economic activity. Higher liquidity ensures that banks have ample funds to lend, further supporting credit growth and market momentum. The foreign investment boost brings additional capital into equities, strengthening market confidence and improving valuations. However, while these factors create a bullish outlook, inflation management and global uncertainties remain key risks. If executed carefully, RBI’s 2025 strategy could drive sustained economic growth, stronger markets, and enhanced investor sentiment.

Conclusion:

RBI is setting up India for a strong economic ride. If inflation remains stable, more rate cuts might come, leading to bullish markets and higher growth ahead. What’s your take? Bullish or cautious?

Sources & References:

- RBI Monetary Policy Report

- Economic Times

Reuters

Until then, Happy Trading!

Commodity Samachar Securities

We Decode the Language of the Markets

Also Read: Get your stops tight — April’s here to fool both sides!

Recommended Read: India’s Semiconductor Surge: Powering the Future of Electronics!

Want Help On Your Trades ?

Chat with RM