Copper prices plunged by 3.16% last week. That was the biggest losing streak since mid November 2022. Base metals prices tumbled last week after a series of hawkish signals from the Fed.

Prices fell particularly hard on Friday after data showed that the Personal Consumption Expenditures index. The Fed’s preferred inflation gauge remained elevated through January, giving the central bank more impetus to keep hiking rates.

Adding to this, news that the United States will impose a 200% tariff on aluminum. And derivatives produced in Russia from March 10. The White House said on Friday. Effectively a ban as it announced sanctions on the anniversary of Russia’s invasion of Ukraine, also weighed on sentiment.

Dollar jumped around a seven-week high against a basket of currencies which continued pressurizing metal prices. While 10-year Treasury yields were now eyeing a move past the 4% level and were at their highest point since early November, also added in negative sentiment.

Mixed economic readings from China, the world’s largest copper importer, saw markets trim their bets on an immediate economic recovery in the country. Even as it relaxed most anti-COVID restrictions earlier this year.

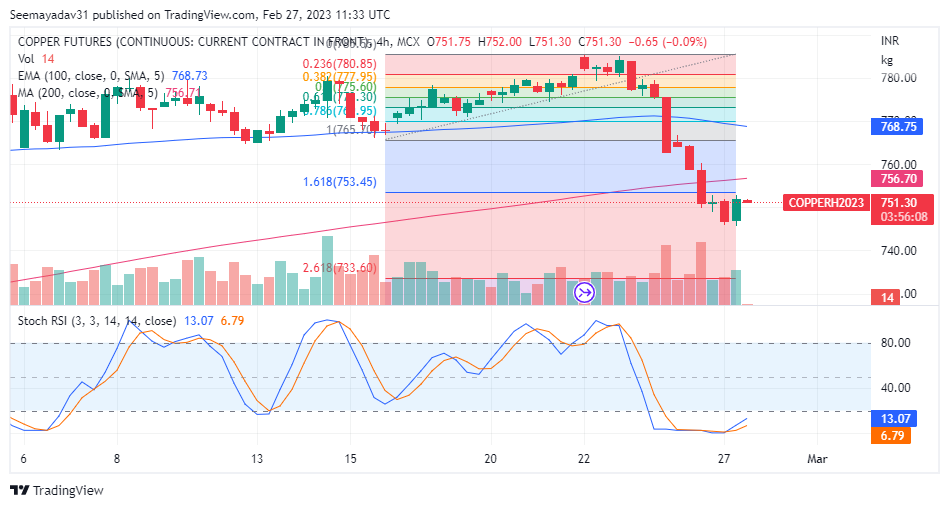

Copper prices plunged more than 3.15% last week, the biggest losing streak since Mid November 2022. And settled at 750.50 as compared to the previous week close of 775.

Copper prices gave a breakdown of crucial support 756.50 coincided with 100 SMA. which is creating probability for a bearish momentum to continue in near future.

Further, 745 will act as a decisive support and a break below on closing basis will open the door for next support 740-735. However, after a steep fall in the recent trading session, some short covering may be seen towards 756.50-757.5 levels. Hence, fresh sell could expect on rise for near future with stop loss above 762.50

On the upside, massive resistance is seen at 767.20 and close above it prices appears to test resistance 772-778.50