Introduction – Natural Gas

The natural gas market continues to be influenced by a dynamic mix of seasonal demand, storage activity, weather developments, and technical patterns. As we move deeper into the summer season, intensifying

heatwaves across major consuming regions like the U.S. and Asia are raising short-term energy demand, especially for cooling. This report provides a comprehensive weekly update on inventory movements,

regional weather conditions, industrial demand trends, and the technical setup in natural gas prices—offering actionable insights for traders and market participants.

Inventory Update:

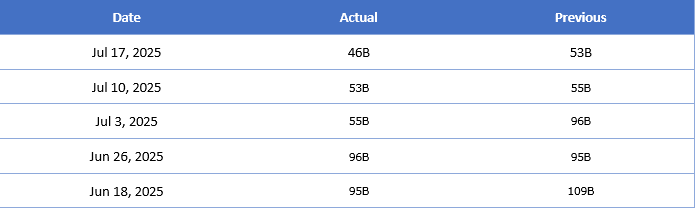

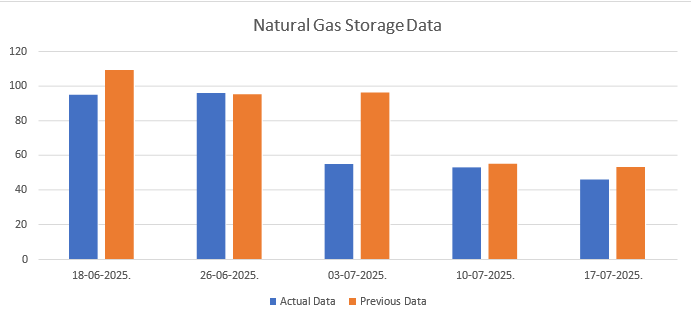

According to the weekly natural gas storage data for the U.S. from June 18 to July 17, 2025. Key insights include:

- Consistent Inventory Decline: Storage levels have declined sharply over the last few weeks, from 95Bcf on June 26 to just 46Bcf on July 17, marking a significant 51% drop in four weeks.

- Below Expectations: The most recent figure of 46Bcf (July 17) came below the previous week’s forecast of 53Bcf, indicating a sharper-than-expected drawdown.

- High Withdrawals: The drop from 96Bcf on July 3 to 55Bcf highlights increased gas usage, likely driven by elevated summer demand due to heatwaves across major consuming regions.

The declining trend in storage levels, especially during peak summer demand, signals a tightening supply- demand balance, supporting a bullish undertone for natural gas prices if this trend continues.

Whether Conditions:

United States:

Ongoing heatwave across key regions is driving high cooling demand, boosting gas usage for power generation. Despite this, strong production and storage have kept prices relatively capped (~$3– 3.5/MMBtu).

Europe:

Weather remains mild, keeping gas demand muted, especially with rising renewable generation. However,

LNG imports are up for winter storage needs. Prices (TTF) recently rose ~6% amid global supply competition.

Asia:

Severe heatwaves in India and East Asia are pushing LNG demand higher, tightening global availability. Spot LNG prices (JKM) have climbed to ~$13/MMBtu as buyers scramble for supplies.

Weather conditions across the US, Europe, and Asia are significantly shaping natural gas dynamics. Intense heat in the US and Asia is driving strong cooling demand, boosting gas consumption for power generation and LNG imports, while Europe’s milder summer has kept demand subdued but storage refill needs remain high. Despite high global production, competition for LNG—especially from Asia—has tightened supply and supported prices. Overall, the weather-driven demand surge, especially from Asia, is keeping the global gas market firm, with potential for further upside if extreme heat persists or winter demand picks up early.

Industrial Demand:

Industrial demand for natural gas is expected to remain steady with a slightly supportive bias. While not as reactive as power-sector demand, industrial usage typically holds consistent unless disrupted by price

volatility or plant outages. With current gas prices staying within a moderate range and no major disruptions reported, industries such as chemicals, fertilizers, and manufacturing are likely to maintain their regular consumption levels.

Additionally, ongoing summer production cycles and stable operating rates at key industrial plants will

support baseline demand. However, any sharp spike in prices or unexpected plant maintenance could briefly curb short-term usage. Overall, industrial demand will continue to offer a stable floor to weekly natural gas consumption.

Technical View:

Technical Outlook:

Natural gas is currently showing bullish momentum, supported by an inverse head and shoulders pattern breakout. The key technical levels to watch are:

- Immediate support at 300, with strong support around 290.

- Resistance remains at 320, with the next major resistance zone around 328.

Additionally, the USDINR is trading at elevated levels, providing favourable conditions for a buying trend in natural gas.

Trade Scenarios:

- Scenario 1: If the market closes above 310 today, it indicates a continuation of the uptrend, and we could see price movement toward 320 – 328. In this case, the buy recommendation remains valid with a stop loss at 300.

- Scenario 2: If the market fails to close above 310, consider initiating a buy position around 300 – 303 for a target of 320 – 328, maintaining a stop loss at 290.

Conclusion:

In summary, natural gas fundamentals remain firm in the short term. A sharp decline in U.S. inventory

levels, driven by strong summer demand, reflects tightening supply conditions. While industrial demand stays steady, elevated cooling needs in the U.S. and Asia—paired with competitive LNG markets—are supporting price strength. Technically, the breakout pattern and bullish structure above key levels reinforce a positive bias. As long as weather-driven demand persists and no major supply shocks occur, natural gas prices may continue to trend higher in the coming sessions.

Happy trading

Chat with Analyst

Also Read – Privacy At Risk? The Dark Side Of Trading Apps!