US-China Tensions: A Commodity Shift for India?

Executive Summary The US -China trade conflict has entered a new and more intense phase. Recently, the U.S. government led by President Trump has temporarily paused most global tariffs for 90 days to calm financial markets. However, the U.S. has significantly raised tariffs on Chinese goods—up to 125%—targeting items like

Gold & Oil: How US Inflation & Trade Tensions Shape Prices

Commodity markets are expected to face significant price swings in the coming week as investors await key US inflation data and ongoing trade disputes. Market participants are keeping a close eye on how these developments will affect commodity prices, particularly in metals and energy, amid continued speculation about the US

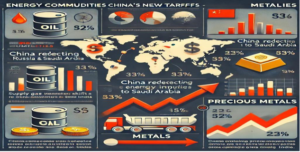

Impact of China’s New Tariffs on Commodities: Energy, Metals, and Precious Metals.

On March 4, 2025, China announced it would impose additional tariffs of 10%-15% on various U.S. imports, particularly agricultural products, metals, and energy. This move is a direct response to U.S. tariffs on Chinese goods and will impact global markets, including India’s commodity markets. Below, we outline the key impacts

Energy Transition: How It’s Shifting Global Commodity Market

The world is changing how it produces and uses energy. With rising concerns about climate change, many countries are now focusing on clean and renewable energy sources like solar, wind, and hydropower. While this shift is necessary for a greener future, it is also creating waves in the global commodity

Markets on Edge: FOMC Minutes & Russia Ukraine Peace Talks to Shape Commodity Trends

The FOMC minutes and Russia-Ukraine peace talks in Saudi Arabia will shape market trendsthis week. A positive outcome could boost risk assets while lowering gold and oil prices.Weak U.S. retail sales and postponed tariffs weakened the dollar, increasing expectations ofFed rate cuts in 2025. This helped U.S. stocks rise, with

Markets React to Tariff Concerns: Stocks Fall, Gold Surges, Oil Slips

Trump’s talk about new tariffs worried the markets this week. The Federal Reserve keptinterest rates the same, saying they need to see lower inflation or job market weakness beforemaking any changes. This pushed the US dollar higher.When Trump confirmed new tariffs, US stocks dropped. Gold hit record highs as investorssought

Gold & Silver Soar: Safe Haven or Hype Amid Tariff Fears?

Gold and silver markets are experiencing a remarkable surge, with gold prices reaching record highs as January 2025 comes to a close. As of January 31, spot gold has touched $2,799.71 per ounce, while February futures traded at $2,849.40, reflecting a nearly 2% increase for the day. This momentum is

Golden Waves, Silver Secrets: A Precious Metal Journey

Golden Waves, Silver Secrets: A Precious Metal Journey As of January 7, 2025, gold (XAU/USD) is trading around $2,645, maintaining its upward trajectory as investors flock to safe-haven assets amid rising geopolitical tensions and inflation fears. The ongoing Russia-Ukraine conflict and instability in the Middle East have intensified risk-off sentiment, pushing gold to

साल 2025 में सराफा व्यापारी सोने 🟡 और चाँदी ⚪ में क्या करें??

क्या चाँदी में आएगी बड़ी तेजी? 📈✨ Happy Trading! Commodity Samachar SecuritiesWe Decode the Language of the Markets. 🧩📉