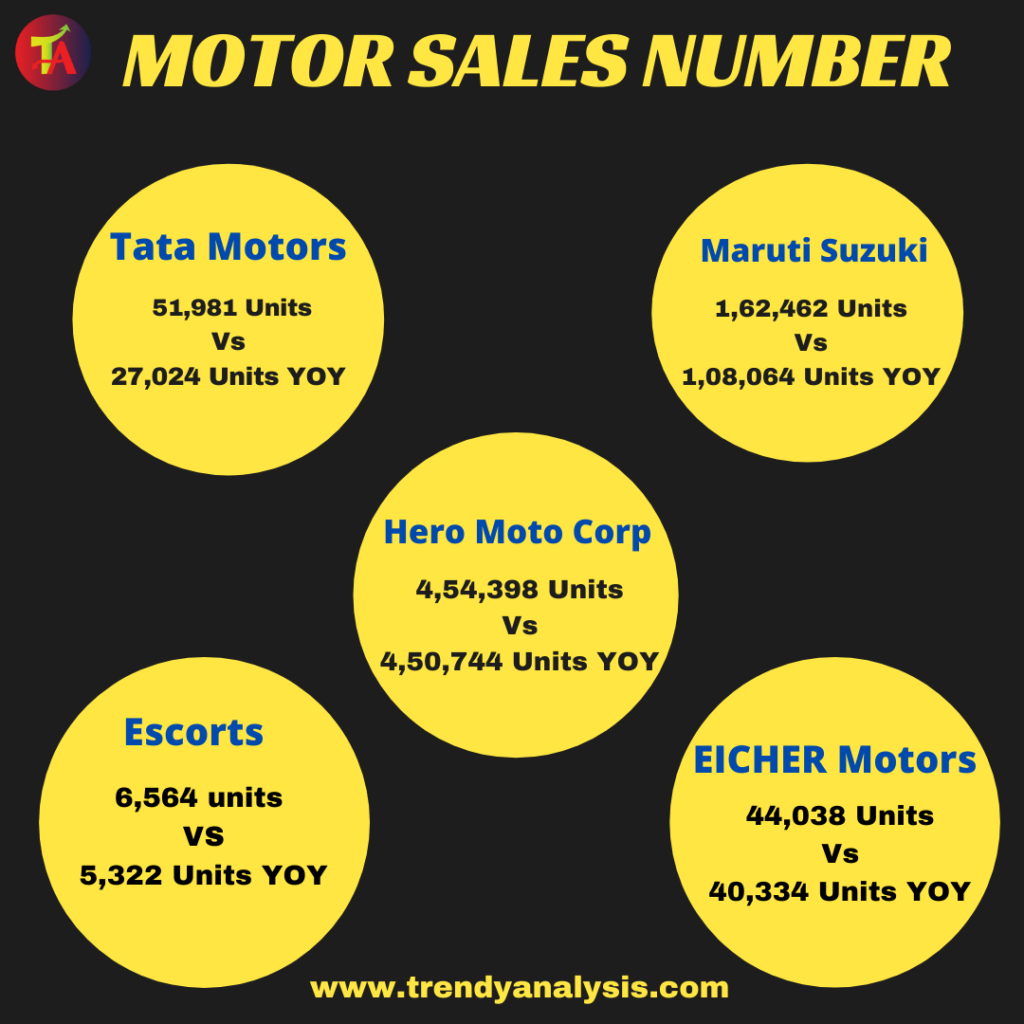

Tata Motors

If we look into the sales figure, then for sure numbers got nearly doubled from the previous quarter i.e. from 27,024 Units to 51,981 Units YOY. Moreover, we did not find the count of sales as much interesting. Covid-19 adversely hit the sales during the initial phase of the quarter. Later on, sales improved but not to that estimated level.

Technical Outlook

Support at 296 and resistance at 300—305.

Decisive break and sustain below 296 will take it to 292—288 and then to 276 levels in days to come.

Traders should remain cautious at the top.

Our negative view turns to negate on a close above 305 levels only.

Maruti Suzuki

The total sales of Maruti Suzuki reflect a slight increase in numbers which stood at 1,62,462 Units for the first quarter. The numbers were severely got impacted due to the spread of pandemics. Consequently, people shifted from luxury to necessity during the second wave of lockdown. However, be vigilant at the top.

Technical Outlook

Maruti Suzuki has support at 6900 and resistance at 7150

A decisive break below 7030 will take it to 6900 levels. More and more downside panic we will see on a close below 6900 levels.

Be cautious at the top. Resistance levels are 7150—7350—7500.

Hero Moto Corp

Sluggish numbers again. Slender increase in sales figure stood at 4,54,398 Units as against 4,50,744 YOY. Motor sales numbers got undesirably impacted due to the challenging environment. Consequently, a negligible amount of change in units is not a good sign and can create panic in the days ahead.

Technical Outlook

Resistance at 2830—2855 ad support at 2700.

Don’t jump for aggressive buying in it until and unless if able to breach the resistance level of 2855 levels.

We expect more downside panic in Hero moto Corp in days to come.

Escorts

Looking into the statistics, the sales upsurges with a tiny numeral which came at 6,564 units as compared to 5,322 Units YOY. Again, a very significant reason for impacting the numbers is the high transmission of coronavirus disease. However, traders should be very watchful during the higher levels.

Technical Outlook

Escorts has support at 1150 and resistance at 1200–1220.

We have seen a sluggish move in Escorts from last few months and expect that this trend will remain continue in this month too.

Traders should be cautious at higher levels as no strength is seeing in it.

Close below 1150 will see more downside panic in Escorts till 1105—1080 levels.

EICHER Motors

An increase of fewer than 5000 units in sales number reveals range-bound trading for traders. Though, there is an increase in sales but not yet very huge. However, the alarm of fearing continues.

Technical Outlook

Eicher Motors has support at 2520—2450 and resistance at 2690—2740.

Major panic we will see in Eicher motors on a close below 2450 levels only or else it will trade within a range for time being.

So traders can trade safely and wait for confirmation.