The white moved neutral at the start of the week, as the market awaited more cues on U.S. monetary policy and inflation numbers. Prices were able to gain slightly as a considerably subdued nonfarm payrolls report put some pressure on the dollar and spurred hopes that the Federal Reserve was close to ending its rate hike cycle.

Officials from the Fed, however, stated that in order to combat excessive inflation, the bank would still need to hike rates in the near future. A Fed rate hike of at least 25 basis points later in July is widely anticipated by the markets.

In light of the fact that rising interest rates increase the opportunity cost of storing non-yielding assets, they are not good for metal prices. Because of this idea, gold prices suffered during 2022 and spent the majority of 2023 trading in a narrow range.

In addition, data released on Monday indicated that, amidst deteriorating economic conditions in the nation, China was on the verge of consumer deflation. However, this raised hopes that the government will implement additional emergency spending programmes to support the economy.

In an effort to sustain the greatest economic drivers in the nation, the People’s Bank of China extended financial support for the faltering real estate sector on Monday until the end of 2024.

Furthermore, U.S. consumer price index inflation data is due to release on Wednesday. The numbers have to be closely watched as it will provide clues for the Fed’s next meeting decision.

Technical Outlook

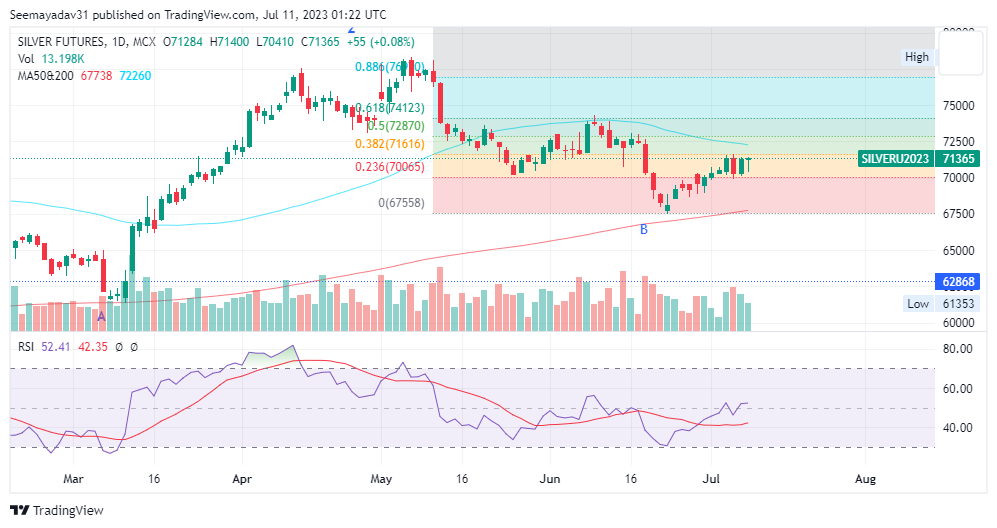

Silver prices had a volatile trade yesterday. After hitting a day’s low 70410 settled at 71365 levels with a minor gain of 0.08%.

On the above chart, prices are able to consolidate above their crucial support of 70050 from the last four sessions which is still indicating that any dip towards 70200-70150 will attract near-future buying activities. Upside target expected at 71650-72000.00.

On the downside, crucial support is intact at 70050 and a break below prices may retreat towards 68500-68050 again.