It goes without saying that inflation in any form and in any country, is bad for the economy. The same goes for the superpower US as well. Moreover, it isn’t just a monetary phenomenon, but it has psychological connotations as well. Till some time back, the US economy was booming. Jobs were returning, and companies had started hiring, and stick markets were also at an all-time high. However, the US inflation struck. The inflation rate seemed to be the highest in October 2021, after the 90s. Although president Joe Biden and the Federal Reserve are not too stigmatized, things can turn over at any moment.

The inflation also came at a time when the economy and population were already under tremendous pressure from the virus. The authorities say that prices are going through a transition phase. It does sound a bit complicated.

Let us try and decode what it is all about now, and what the repercussions can be in the near future.

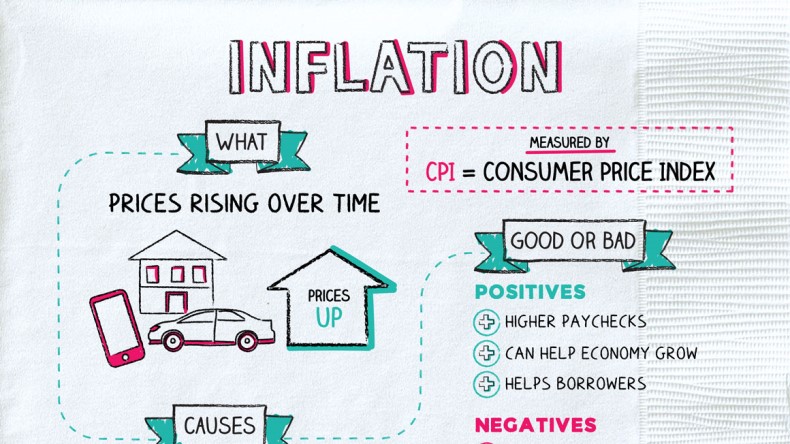

For the unversed, Inflation meaning indicated an increase in the prices of all kinds of goods and services for consumers. There is no particular category as such, as the rates differ from one to another. The Consumer Price Index is the most commonly used tool to measure inflation. According to CPI, the prices of many products and services rose by 6.2% as compared to the prices around the same time the year before. The main areas where prices increased manifold are housing, food, energy, vehicles, and entertainment. However, there was also a certain decrease in prices related to airline fares and alcohol. It is mostly believed that, the inflation results are mainly due to the pandemic. The other figures like the creation of more jobs and increased retail sales, point towards otherwise good times.

The biggest impact that is noticeable are an increase in prices in-store, investment avenues in house and land, or in the medical sector. The wages may or may not be able to cope with the inflation. Thus, the general population will think and then spend money. Thus, leading to fewer sales in non-essentials.

The US inflation also has a huge impact on the political scenario in the country. Most voters are blaming the ruling party for the rising prices. Many have even condemned the current President for overspending reserves in government aid. The authorities are keeping their fingers crossed, as they hope that the same situation will not last long. For the unversed, the current inflation rate in the US is 8.3%.

One should know about the different types of inflation. The main types are:

Demand-Pull Inflation – It mainly points toward the short-supply of things that leads people to pay more. If you are still going for a holiday, despite the fares being high, then that can be termed as demand-pull inflation. This sort of inflation is on the rise in the US, as people have rising incomes and they want to spend that money.

Built-In Inflation – As the other two inflations rise, most workers will start pressurizing the company for more wages and salary. If the employers do not give in to th demands of the workers, then they will face a labour shortage. The employer will often succumb to the pressures of the workers, and raise their wages, only to recover the same from the final consumers.

Cost-Push Inflation – When demand-pull inflation is high, cost-push inflation comes in. When the cost of raw materials increases, there is a subsequent rise in the price of products and services. If businesses are to maintain their profits, raising prices is the only option.

While unearthing the different types of inflations, that can cause the people a lot of hassles, it is even more important to highlight other types that have affected the US or might in the future.

Stagflation is one of the types of inflation, that occurred in the 1970s. It mainly aims at an economic crisis, that is a result of slow growth, unemployment, declining wages, and rising prices. The concerns about this kind of inflation seemed like taking off, when Covid struck. However, all the scenarios mentioned above generally do not occur together. So, it may not be occurring any time soon.

The retail inflation meaning is also a good thing to unearth here. Around February the retail inflation in the US was also at an all-time high. Even India fared better, as compared to the last 30 years or so. The US reported a CPI of 7.5% as against 6.1% of India. The sharp increase in retail inflation rate in the US had also given rise to fears, that it could hurt other emerging and developing markets, like India’s. For the unversed, retail inflation is the increase in the prices of consumer goods and services, due to the passing of all manufacturing costs to the end consumer. An increase in fuel prices can also be blamed. And the impetus seems to point towards the tensions between Russia and Ukraine.

What do we Expect in Gold?

Here in the above chart, the resistance zone of Gold is $1730. If gold crosses the $1730 on closing basis then we may witness a good buying opportunity. Furthermore, traders may buy gold before CPI Inflation around $1650—$1640 with a strict stop loss of $1610. We may witness upside targets between $1690—$1710. Consequently, a major trend reversal will be observed if Gold closes above $1730.