Introduction Copper :

This week, copper prices faced a critical test as the market reacted to tight global supply, weak Chinese demand, and technical exhaustion near resistance zones. Despite a fundamentally supportive backdropincluding falling LME inventories and strong long-term demand trends prices retreated, highlighting the impact of short-term pressures and profit booking.

Both COMEX and MCX Copper reversed from key resistance levels, signaling a pause in momentum. Meanwhile, rising COMEX inventories and soft industrial cues from China added to caution in the market.

As fundamentals and technical diverge, this report provides a focused breakdown of the key trends, helping market participants navigate the near-term volatility while keeping an eye on the bigger picture.

FUNDAMENTALS AFFECTING COPPER

Why Copper Declined This Week – Fundamental Perspective

Despite a supportive long-term outlook, copper prices saw a pullback this week due to a combination of short-term fundamental pressures. The decline is not just the result of technical profit booking but is also driven by real shifts in demand, supply, and macroeconomic sentiment.

1. Sluggish Demand from China Weighs on Sentiment

China’s manufacturing activity remains subdued, as reflected in recent PMI and industrial output data. Copper rod production in China dropped sharply, with weekly operating rates falling to 63.7 percent. This signals weak demand from key downstream sectors like construction and electrical manufacturing, putting pressure on refined copper consumption.

2. COMEX Inventory Surge Creates Temporary Oversupply

While global copper inventories are tightening, COMEX stocks have risen by 87 percent since February due to front-loading ahead of US tariffs. This localized inventory build-up has created a temporary sense of oversupply, weighing on futures prices and contributing to short-term weakness, especially in the US market.

3. Stronger US Dollar Adds to Headwinds

The US dollar strengthened this week, supported by firm economic data and cautious Federal Reserve guidance. A stronger dollar makes copper more expensive for buyers using other currencies, which typically dampens international demand and puts downward pressure on dollar-denominated commodities like copper.

4. Continued Smelter Activity Despite Margin Pressure

Treatment and refining charges (TCRC) have dropped to record lows, with Chinese smelters even accepting zero-dollar deals. Despite these margin pressures, smelters continue production, recovering value from by-products such as gold and sulfuric acid. This has prevented a sharper reduction in refined copper output, keeping near-term supply more stable than expected.

5. Profit Booking at Key Technical Levels

Copper faced repeated rejection near major resistance zones around four point eight five to four point nine zero dollars on COMEX and eight hundred seventy to eight hundred seventy-five rupees on MCX. These levels triggered short-term profit booking among traders, contributing to the pullback after a strong rally in previous weeks.

Copper’s decline this week is the result of a mix of short-term supply and demand imbalances, currency movements, and technical resistance. While long-term fundamentals remain bullish, driven by structural demand and tightening global supply, near-term pressures are keeping prices in check.

India’s Copper Mission Adds Bullish Tailwind

India’s move to boost domestic copper smelting and secure long-term concentrate supplies is a clear signal of rising structural demand. With limited local reserves and an ambitious growth outlook, India will increasingly rely on imports—putting it in direct competition with other major buyers globally.

This shift is bullish for copper prices over the medium to long term:

- Higher Raw Copper Demand: As smelters are set up, India will import more copper concentrates, tightening global supply.

- Global Competition Heats Up: FTAs with Chile and Peru could divert copper flows, creating regional supply pressure.

- Support for Long-Term Prices: With demand set to triple by 2047, India becomes a major anchor for global copper consumption.

In short, India’s strategy is not just about self-sufficiency it introduces a new demand engine into an already tight global copper landscape. This adds a strong floor under prices and supports the long-term bullish narrative.

1. Chinese Processing Fees Hit Record Lows (TCRC)

Treatment and Refining Charges (TCRC) are the fees that miners pay to smelters for converting copper concentrate into refined copper. Recently, Chinese smelters agreed to a zero-dollar TCRC deal with Chilean mining company Antofagasta, marking the lowest level ever recorded.

This unusual arrangement reflects a global shortage of copper concentrate, where smelters are willing to process materials with little or no profit just to maintain operations. To manage the financial impact, many smelters are relying on by-products such as gold and sulfuric acid to support their revenues.

This situation highlights a tight supply environment in the upstream copper market and supports a fundamentally bullish outlook for copper in the medium term.

2. Production Cuts in China

As copper prices surged above 80,000 yuan per ton, several Chinese cathode-rod producers have reduced output due to rising costs and squeezed margins. Weekly operating rates have fallen to 63.7 percent, a decline of 10 percentage points, indicating a slowdown in production activity.

This decline in operating capacity reduces the availability of refined copper in the market, adding to overall supply-side pressure. If demand remains stable, this reduced output may contribute to further price support.

These developments suggest that supply-side tightness continues to shape the copper market outlook, even as short-term pricing may face volatility from external macroeconomic factors.

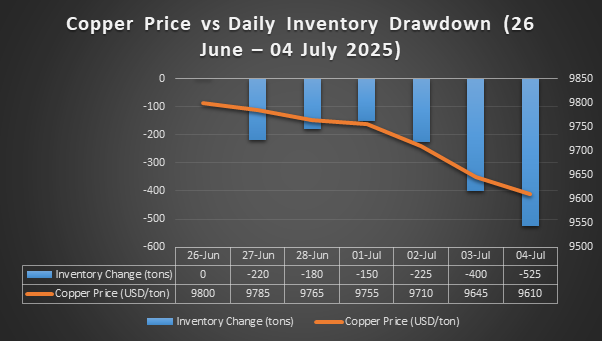

Price & Inventory Connection

Inventory Pressure Builds Despite Price Decline

The chart clearly illustrates a consistent decline in LME copper inventories over the past seven trading sessions, reflecting tightening physical supply. From June 26 to July 4, inventories fell by a cumulative 1,700 tons, with the largest daily drawdown of 525 tons recorded on July 4. This steady inventory depletion typically indicates rising demand or constrained supply — both generally bullish signals for copper.

However, the copper price moved in the opposite direction, falling from $9,800 to $9,610 per ton during the same period. This divergence suggests that despite supply tightening, macroeconomic concerns, weak industrial demand from China, and strong COMEX stockpiles are dominating short-term sentiment, leading to price pressure.

In summary, while the inventory trend supports a bullish outlook from a supply perspective, market participants remain cautious due to external demand-side uncertainties, resulting in the current price correction.

TECHNICALS OF COPPER:

🔄 Recap of Last Week’s Copper Outlook: What We Said vs What Happened

In our previous weekly report, we highlighted that COMEX Copper was trading near a strong resistance zone between $5.08–$5.17, with visible rejection on the 4H chart. We cautioned against fresh long positions in this supply zone and anticipated possible profit booking or pullback. This view played out well, as copper failed to sustain above resistance and started correcting lower.

On the MCX Copper front, we identified a resistance band between ₹897–₹916and advised partial profit booking around ₹905, which was nearly achieved. Price faced rejection as expected, and our wait-and-watch stance above resistance helped avoid unnecessary risk as prices retraced from highs.

COMEX Copper: Reversal from Resistance Suggests Caution

This week, COMEX Copper reversed from a key resistance in daily time frame zone between $5.08 and $5.21, a level that has historically acted as a strong supply barrier. The price action indicates profit booking at higher levels, which has temporarily weakened the bullish momentum.

On the downside, immediate support lies between $4.98 and $4.90. A sustained break below this zone could accelerate the correction, with the next major support seen near $4.75, a level that previously attracted strong buying interest.

However, if the price manages to break above the previous high, it would signal renewed bullish strength and could lead to strong upside momentum supported by fresh buying. Until then, traders should remain cautious and watch for price stability near key support before considering long positions.

📊 MCX Copper: Weekly Pin Bar Near Resistance Signals Caution

This week, MCX Copper formed a strong reversal candle on the weekly chart, with prices rejecting the ₹906 resistance level and forming a visible pin bar a classic sign of seller dominance at higher levels. This bearish signal suggests that the recent upside may be losing steam.

If the price closes below this reversal candle on the daily chart, it could trigger further downside, with immediate support seen in the ₹887–₹865 zone. A breakdown below ₹887 may open the door for a deeper correction toward ₹865, which has historically acted as a strong demand zone.

On the upside, resistance remains between ₹906 and ₹915, and unless this range is decisively breached, the technical setup favors selling on rise in the short term.

While fundamental sentiment remains positive supported by tight global supply and robust long-term demand the technical structure shows signs of a bearish pullback from a key supply zone. Therefore, traders should be cautious of near-term weakness.

That said, ₹865 remains a key level to watch. If a strong bullish reversal pattern emerges from this support, it could offer a high-probability buying opportunity aligned with the broader trend.

Conclusion: Navigating the Near-Term Pause in a Long-Term Bullish Story

While the broader outlook for copper remains structurally positivedriven by tightening supply chains, global clean energy investments, and India’s long-term demand trajectorythis week’s price action highlights the market’s sensitivity to short-term macro triggers.

Weakness in Chinese demand, a stronger U.S. dollar, and COMEX inventory build-up have introduced temporary pressure, leading to profit booking near major resistance zones. Technical signals from both COMEX and MCX charts support a cautious, wait-and-watch approach, particularly as prices test critical support levels.

In the coming sessions, sustained price action above key support zones will be crucial to revive bullish momentum. Until then, traders and investors should remain selective, focusing on value zones for accumulation rather than chasing strength at the top.

Happy Trading

Chat with Analyst