The financial markets experienced a whirlwind of volatility on Friday, as both gold and the U.S. dollar showcased remarkable resilience, challenging initial reactions to the December nonfarm payroll report. Despite an early selloff, both assets managed to close higher, defying conventional market expectations.

The Labor Department’s report revealed that December nonfarm payrolls surged by 256,000, significantly surpassing Reuters’ consensus forecast of 160,000 and exceeding November’s revised figure of 227,000. This robust employment data triggered an unexpected response across various asset classes.

Interestingly, the gains in gold contradicted what many traders anticipated following such a strong jobs report. The data increased the probability that the Federal Reserve would not cut rates in January to a staggering 97.3%, with a 74% likelihood that the Fed would maintain its current funds rate between 4.25% and 4.50% at the March FOMC meeting.

In a notable deviation from typical market dynamics, gold futures displayed impressive strength. The February contract opened at $2,692.90, briefly dipped to an intraday low of $2,686.60, but then staged a remarkable recovery to reach $2,735. By 4:25 PM ET, gold had secured a 0.90% gain, settling at $2,716.50, up $24.10 for the session.

Similarly, the dollar index demonstrated resilience despite initial weakness. It opened at 109.295, dipped to 109.165 following the jobs report, before mounting a strong comeback to reach 110.075. The session concluded with the dollar index up 0.48%, closing at 109.78.

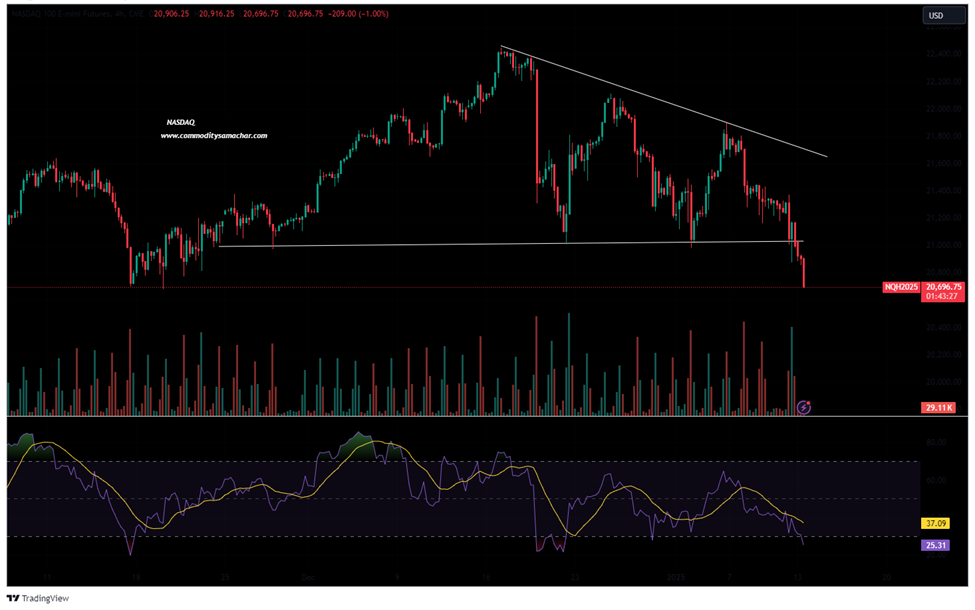

In contrast, equity markets reacted negatively to the employment data. The Dow Jones Industrial Average plummeted by 712 points, or 1.7%, while the S&P 500 fell by 1.8%. The technology-heavy NASDAQ Composite faced the steepest decline, dropping by 2.1%.

Market analysts suggest that gold’s positive performance reflects broader concerns beyond traditional interest rate considerations. Despite the strong jobs report reducing the likelihood of a January rate cut to just 2.7%, with a 74% probability of rates remaining between 4.25% and 4.50%, investors seem focused on multiple risk factors.

These concerns include potential inflationary pressures, ongoing geopolitical tensions, and domestic political uncertainties. Analysts have highlighted particular attention on potential Trump administration policies regarding tariffs and their inflationary impact, as well as worries about fiscal debt expansion. Saxo analysts reported that these factors have led to increased physical gold accumulation among Chinese traders.

The trading patterns observed throughout the day suggest a market increasingly focused on hedging against various risks rather than solely reacting to monetary policy expectations, indicating a potential shift in market sentiment and traditional correlations.

While robust employment data typically signals confidence in economic growth and might lead to rate cuts being sidelined, this time it has spurred a complex interplay of asset movements—especially for gold and the dollar—reflecting deeper market anxieties and strategic repositioning by investors amidst evolving economic landscapes.

Until then, Happy Trading!

Commodity Samachar Securities

We Decode the Language of the Markets

Also Read: Crude Oil Price Surge: Sanctions and Cold Weather Impact , Pound Hits 14-Month Low: Will ‘Trump Trade’ Worsen Slide?

Recommended Read: 2024 G20 Summit: Did It Deliver on Market Expectations?

Want Help On Your Trades ?

Chat with RM