Gold and silver prices saw an uptick in early U.S. trading on Thursday, driven by fresh safe-haven demand amid a budget crisis in the U.K. February gold rose by $18.10 to reach $2,690.50, while March silver increased by $0.36, reaching $31.05.

The financial markets in the U.K. faced significant turmoil overnight due to concerns over the government’s budget deficit, leading to a decline in the British pound against the U.S. dollar, which hit its lowest level in over a year. The yield on 10-year U.K. gilts surged to 4.92%, and the FTSE 250 Index fell for the third consecutive day, raising worries about potential contagion effects globally.

Technical Outlook for Gold:

- February gold futures currently have a near-term technical advantage for bulls.

- The next upside objective for bulls is to close above solid resistance at $2,700.00.

- Bears aim to push prices below solid support at the November low of $2,565.00.

Key resistance levels are seen at $2,700.00 and $2,718.00, while support levels are at $2,673.70 and $2,650.00.

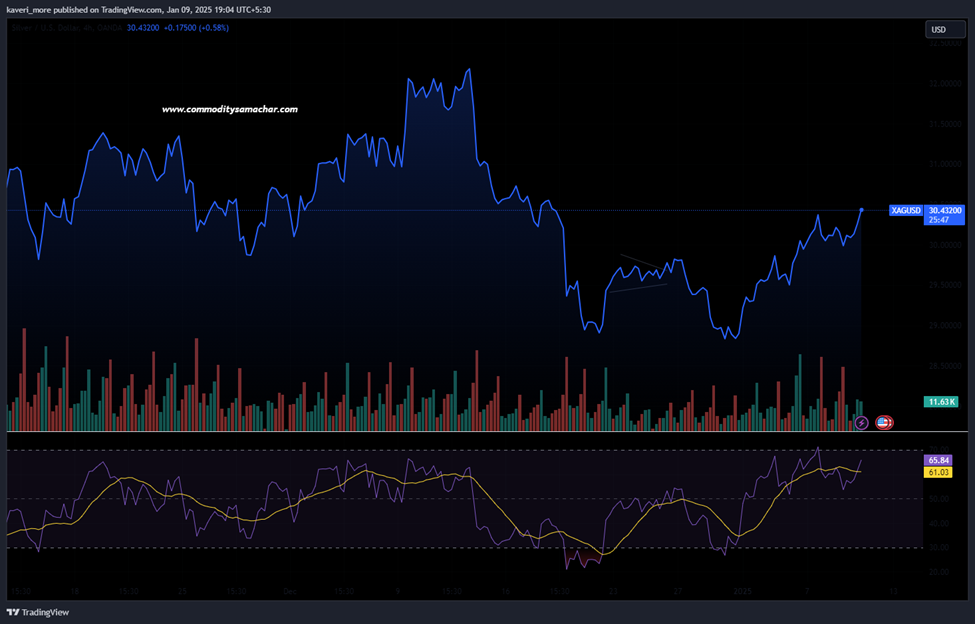

Technical Outlook for Silver:

- March silver futures show a slight near-term technical advantage for bears.

- A nine-week downtrend is still evident on the daily bar chart.

- Silver bulls need to close above solid technical resistance at $32.00 to negate the downtrend.

- Bears are targeting a close below solid support at the December low of $29.145.

- Resistance levels are at $31.50 and $32.00, with support seen at $30.50 and $30.00.

While gold is benefiting from current market conditions with bullish momentum, silver is facing challenges due to an ongoing downtrend but has potential for recovery if key resistance levels are breached.

Until then, Happy Trading!

Commodity Samachar Securities

We Decode the Language of the Markets

Also Read: Crude Oil Prices Drop—Winter Demand to Change the Game? , China CPI, German Retail sales data in Focus today

Recommended Read: 2024 G20 Summit: Did It Deliver on Market Expectations?

Want Help On Your Trades ?

Chat with RM