Yesterday’s Pick

SHORT TERM PICK NATIONAL ALUMINIUM CO LTD RS.5,200/-(400 Quantity) 7%ROI

SH KELKAR & CO. LTD RS.5,200/- (400 Quantity) , 9% Return

BANKNIFTY SEP 54000CE & PE STRADDLE POSITION SELL 150 Point

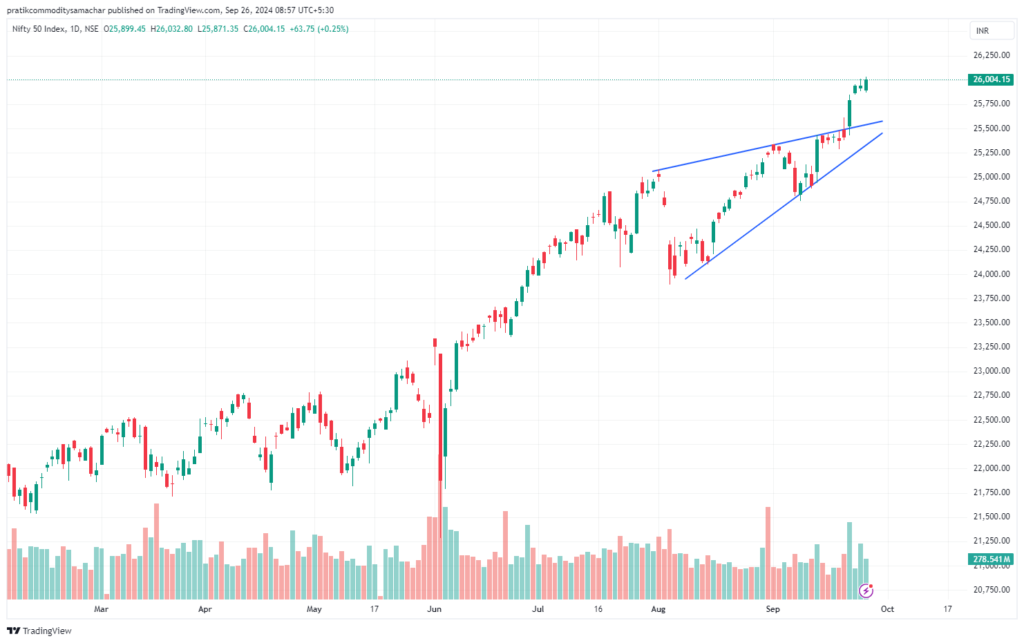

Nifty Technical View

The Nifty 50 continued its upward streak for the fifth day in a row on September 25, closing at a new high of 26,004 points. This positive momentum is expected to continue as long as the index stays above 26,000 points. The next potential resistance levels are at 26,200 and 26,300, while the support level is at 25,800 points.

India Vix

The India VIX, or the fear index, fell by 4.85 percent to 12.74, down from 13.39 levels. This marks the lowest level of volatility in the last 10 months. The decline in volatility is positive for bulls as it indicates a decrease in investor fear and uncertainty.

Nifty PCR

The Nifty Put-Call ratio (PCR) increased to 1.33 on September 25, indicating a bullish sentiment in the market. Traders are selling more Put options than Call options, which suggests that they are expecting the market to rise.

FII And DII Data

Foreign institutional investors (FIIs) were net buyers of Indian stocks on September 25, purchasing ₹1778.99 crore worth of shares. However, domestic institutional investors (DIIs) were net sellers, offloading ₹973.94 crore of stocks.

Stocks To Watch

IDFC: IDFC Ltd on Wednesday, September 25, that it has received a green light from the National Company Law Tribunal (NCLT), Chennai, for the merger of IDFC Financial Holding Company with IDFC and their merger into IDFC First Bank.

Vedanta: Mining major Vedanta said on Wednesday, September 25, that its board will meet on October 8 to consider a fourth interim dividend for FY25. The record date for the dividend, if declared, will be October 16.

Pharma stocks: Shares of pharma companies are expected to be in focus as in its latest monthly drug alert list, the Central Drugs Standards Control Organization (CDSCO) declared 53 drugs as “Not of Standard Quality (NSQ) Alert.”

Nifty and Bank Nifty Support and Resistance level

NIFTY :-

Resistance 26,050, 26,100, and 26,150.

Support based 25,850, 25,750, and 25,700

BankNifty :–

Resistance : 54,200, 54,300, and 54,500

Support based 53,850, 53,700, and 53,550

Index Future levels

Nifty Futures Buy Around 26,000 The suggested targets for this are 26,100 and 25,250 with the stop loss set at 25,850

Bank Nifty Sell Around 54,100 index is expected to upside levels of 54,250 and 54,400 and level 53,800 will act as a stop loss.

Momentum Pick: VEDANTA LTD

Buy above ₹ 484| Target price: ₹ 510/540 |Stop Loss:₹ 450

Vedanta Ltd is a diversified natural resource group engaged in exploring, extracting and processing minerals and oil & gas. The group engages in the exploration, production and sale of zinc, lead, silver, copper, aluminium, iron ore and oil & gas. It has presence across India, South Africa, Namibia, Ireland, Liberia & UAE. Its other businesses includes commercial power generation, steel manufacturing & port operations in India and manufacturing of glass substrate in South Korea and Taiwan.

In the Oil & Gas segment, the Co. intends to undertake new growth capex projects worth $687mn. In the Aluminium segment, it intends to incur a $1.4 bn growth capex over 2 years. This includes aluminium capacity expansion to 3 MTPA by Q3 FY24, Alumina capacity expansion to 6 MTPA by FY24 & 100% operationalization of 3 coal mines in a phased manner by Q3 FY24.

Happy Trading!

Commodity Samachar Securities

We Decode the Language of the Markets

Also Read: Copper sparked after China stimulus measures – What next?

Recommended Read: MCX Commodities Uncovered: The Must-Knows and Essential Insights [2024]

Want Help On Your Trades ?

Chat With RM