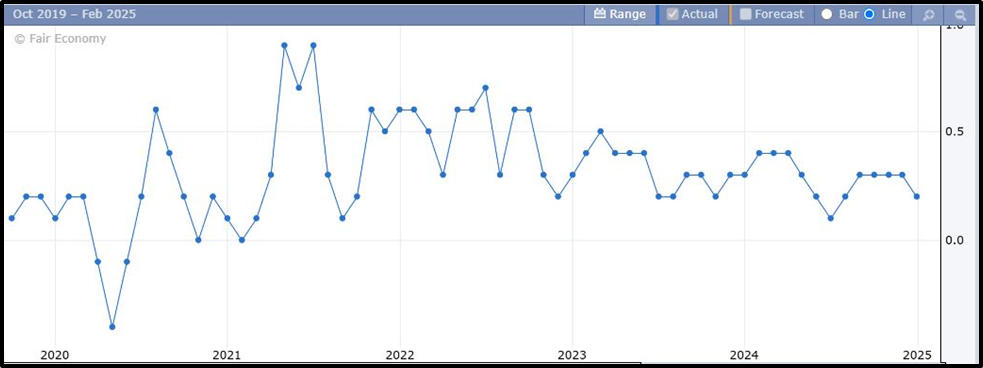

In December 2024, the inflation landscape in the United States presented a complex picture, as the Consumer Price Index (CPI) recorded a 0.4% increase for the month and a 2.9% rise year-over-year, aligning with market forecasts. This marks the third consecutive monthly increase in CPI, primarily fueled by a significant 2.6% jump in energy prices, particularly gasoline, which contributed over 40% to the monthly rise.

Core Inflation Insights

While the overall CPI indicates broader economic trends, core CPI—excluding food and energy—rose by only 0.2%, slightly better than the expected 0.3% increase. On an annual basis, core inflation is at 3.2%, representing the slowest growth rate in over three years.

This easing suggests some reduction in price pressures; however, it remains well above the Federal Reserve’s target of 2%, highlighting ongoing challenges for policymakers.

Market Reactions and Economic Implications

The latest inflation data has had notable effects on financial markets, leading to a decline in the U.S. Dollar by approximately 0.5% and a decrease in the 10-Year Treasury yield below recent highs. This shift in financial conditions has been positively received by equity markets, which saw gains exceeding 1.5% following the report. Despite these positive market responses, economists warn that while inflation shows signs of moderation, it does not equate to a definitive victory over rising prices. The Federal Reserve is navigating a complicated landscape as it strives to balance economic growth with inflation management.

Rate cut Expectations

Looking ahead, there is speculation that the Federal Reserve may pause its interest rate cuts or even consider raising rates again due to stronger-than-expected economic indicators. The Labor Department reported that payrolls grew by 256,000 in December, surpassing expectations and prompting some economists to predict fewer rate cuts this year. Additionally, the unemployment rate dipped to 4.1%, reinforcing views of a stabilized labor market. Consequently, Bank of America economists have adjusted their outlook and no longer anticipate further rate cuts, while yields on benchmark 10-year Treasuries surged to their highest levels since November 2023.

Looking Ahead

Consumer trends remain robust, with expectations for retail sales growth at 0.6% month-over-month, down slightly from November’s 0.7%. However, initial jobless claims are projected to rise from 201K to 210K, reflecting potential shifts in labor market dynamics as 2025 unfolds.

Gold Market Dynamics

Gold has breached the resistance of $2700 per ounce. Technical indicators suggest bullish momentum could push prices higher further up to the next resistance of $2,726, followed by the record high at $2,790. Conversely, should gold prices fall below $2,650, support levels at the 50-day and 100-day moving averages may come into play.

Overall, while December’s inflation data offers some signs of easing pressures, significant hurdles remain as core inflation continues to exceed desired levels and economic uncertainties persist on the horizon. The interplay between inflation trends and labor market dynamics will be crucial as we move into 2025.

Until then, Happy Trading!

Commodity Samachar Securities

We Decode the Language of the Markets

Also Read: Aluminum Price Soars: Are Supply Worries Fueling the Surge? , UK GDP, US retail sales data in Focus today

Recommended Read: 2024 G20 Summit: Did It Deliver on Market Expectations?

Want Help On Your Trades ?

Chat with RM